The local equity markets performed very strongly over the last quarter of 2021 - the Satrix 40 ETF went up 13.2% (from R59.34 as at 30 September 2021 to R67.20 as at 31 December 2021) which also meant that the performance for the last 12 months was a 23.1% increase.

Although there was some nervousness around Omicron and what it could bring, once it was established that it wasn't as severe as was initially feared, the markets soared again in late November and December.

If you look at our other 3 market updates for 2021 you will see that the market dropped slightly in 2 quarters but now also gained strongly in the other 2 quarters. So although there was a 50/50 split between quarterly gains and losses, the net result was a 23.1% gain!

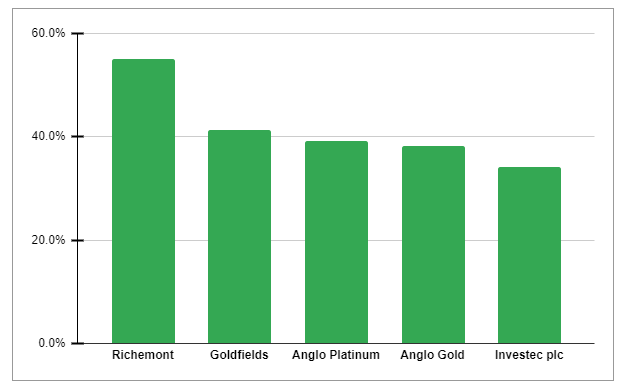

Winners

Richemont is a luxury goods company (think Cartier, Mont Blanc, Dunhill, Panerai etc!) which released a very strong set of half year results in November 2021 where recent sales was much higher than even pre-pandemic levels. The jewellery and watch businesses both showed very strong growth and comfortably beat what the market expected. This is expected to continue hence the 55% share price growth over the last quarter. Looks like some people have got lots of money to spend on these luxury items!

Goldfields and AngloGold Ashanti both recovered from a poor Q1-3 2021 showing as they performed well along with other resources businesses. Gold as a commodity is often seen as a safe haven when inflation increases.

Rather than be influenced by PGM price movement or company results, Anglo Platinum's performance seemed to be driven by corporate activity in the platinum sector where Impala Platinum and Northam Platinum both paid up for chunky stakes in Royal Bafokeng Platinum.

Investec continued its great 2021 performance with a further 34% surge.

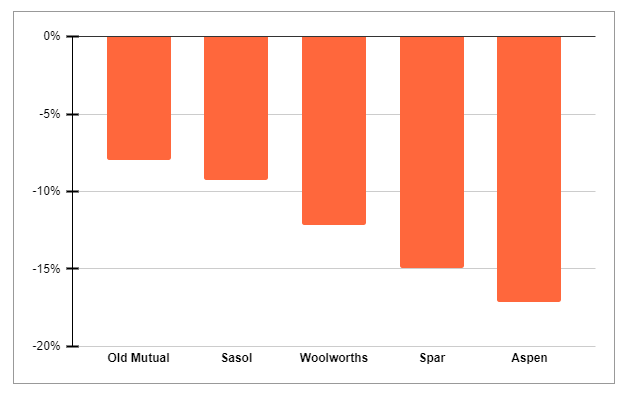

Losers

Aspen and Sasol both had a very strong 2021 when one looks at the full 12 months - as previously mentioned Aspen posted strong results and positive news on vaccination production and Sasol also showed operational improvement on the back of the Lake Charles disposal and higher oil prices. However over this quarter they both gave back some of their previous gains as some profits were taken by investors.

Woolworths and Spar both posted disappointing market updates over the last quarter. Both were impacted by the unrest and looting that took place in Gauteng and KZN during the year as well as the country-wide loadshedding which would have impacted operating hours of some stores. Woolworths also has a large business in Australia which was impacted by the continuing lockdowns as a result of Covid-19 restrictions.

Markets are at an all time high at the moment so if you are trying to time the market (which we discourage!) it could be a dangerous time to start speculating. High inflation and rising interest rates are normally warning signs for equity investors but if you continue investing consistently and not pay too much attention to short term market movements, history shows that you should be OK in the long run. It should be an interesting next 12 months so just keep calm and stick to your plan. Don't panic if the market dips!

![What's the Level of Financial Literacy in South Africa? [+ financial literacy quiz]](/blog/content/images/size/w600/2023/09/financial-literacy.png)