So how did the Satrix Top 40 ETF do?

As at the 31st of May, the Satrix 40 ETF, which is the equity fund you'll find on the Franc app, closed at R70.72. That’s a decrease of 3.4% over the past month (R73.22). However this is still an increase of more than 5% from the beginning of the year (R67.28).

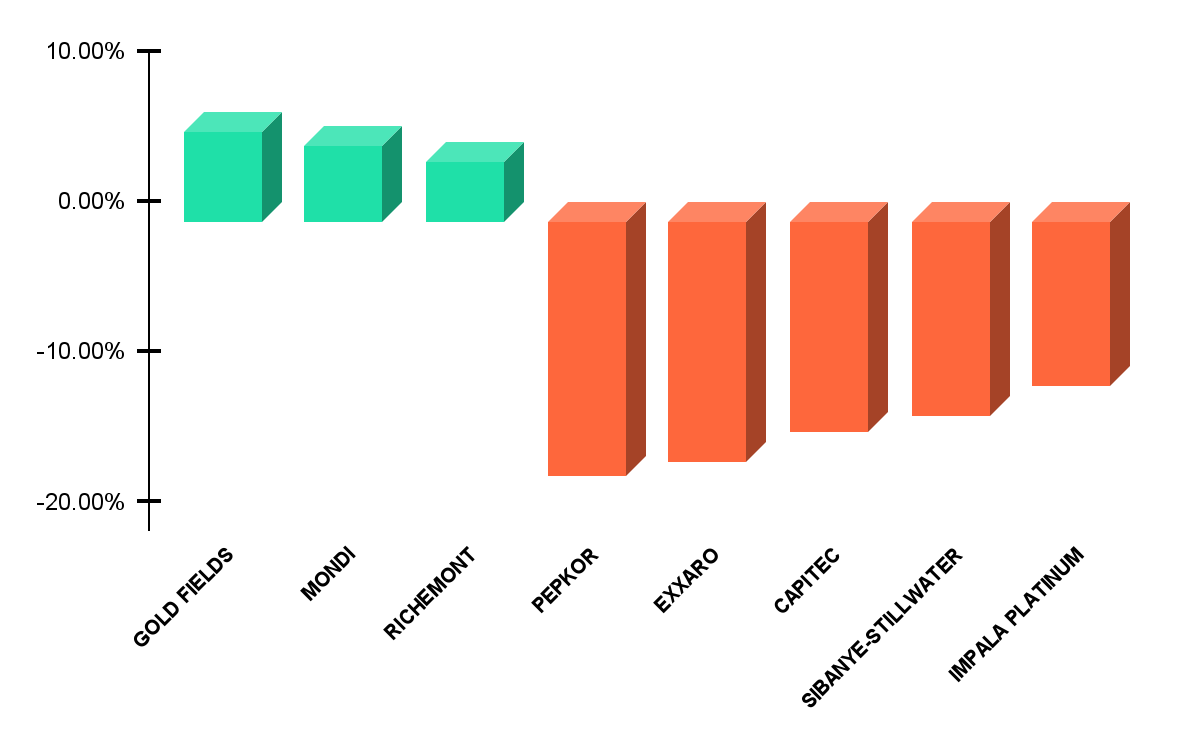

Let’s look at the performance of some of these individual companies’ shares within the fund:

Selected Top & Bottom Performers - May 2023

After five months of 2023, seven of the forty shares are down over 20% in the fund.

Much of this decline has come in recent weeks as local companies find themselves under enormous pressure as overseas investors continue to offload their investments.

Major platinum group metal (PGM) producer; Impala Platinum as well as other commodity companies; Sibanye-Stillwater and Exxaro Resources are all down more than 20% since the start of the year. Commodity prices have declined across the board, meaning earnings and cash flows have been under continued pressure. This is even before factoring in the ongoing fiasco at Transnet, which has resulted in companies shifting transportation of commodities from rail to road. This is done at a greater cost, which continues to decrease profit margins.

Other big losers are Capitec and Pepkor as Capitec’s share price has fallen 20% from the end of the first quarter and 14% in May alone. Pepkor has also seen a big decline as the clothing company’s share price has decreased 17% in the past month. This is due to clothing sales volume decreasing as cash strapped consumers continue to cut spending.

On the positive side of things there were a few companies in the green this past month. Mondi’s (multinational packaging and paper group) share price increased over 5% this past month. This was mainly due to continued impressive financial performance. Richemont (luxury goods manufacturer) continues to impress with a further 4% increase in its share price as demand for luxury goods continues to increase. Like luxury goods, the demand for gold continues to soar and so did Goldfields’ share price as May resulted in a further 6% gain.

May the force be with you!

Increased interest rates and ongoing loadshedding have partly contributed to May’s slide in performance. However, this is another reminder that investing in the equity market is a long term practice as short term losses are inevitable but you have a good chance of positive returns the longer you remain invested. Although this month's performance seemed to be on the DARK SIDE of things, a new month brings A NEW HOPE.

![How & Why You Should Do a Financial Reset [+ downloadable financial reset journal]](/blog/content/images/size/w600/2024/12/Setting-goals-for-the-year.png)