Setting financial goals is an important step in achieving your dreams and establishing your financial security and stability. If you’re about to sit down to write out your new year’s goals, reevaluating your current set or you’ve already given up on ever achieving what you’ve set out for yourself, maybe it’s time to give this a read.

We chatted to financial advisor and The Wealth Coach, Aron Samuels, to get some insights based on what he’s seen work with his clients. In this blog post, we talk about setting SMART goals, healthy habits to put in place to stick to them, and what to avoid when making big plans.

Why setting financial goals helps you

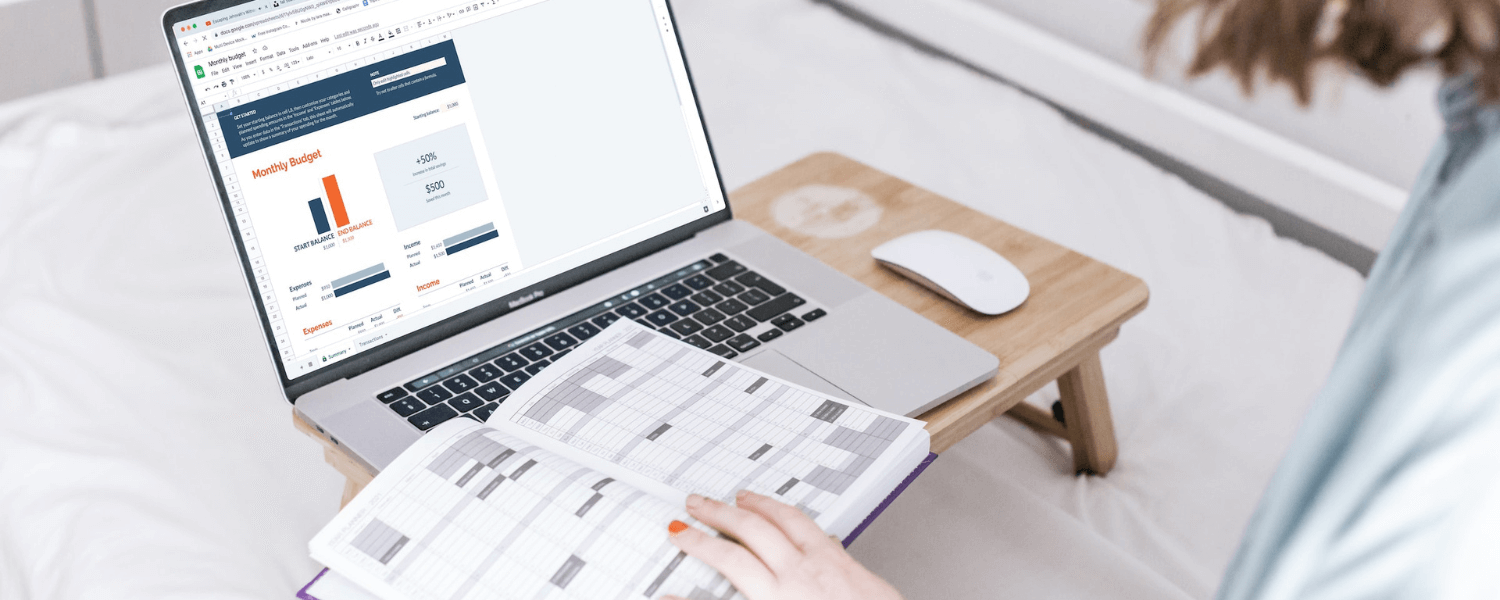

The main reason why setting financial goals is important is that it will help you prioritise your spending and saving. When you have clear financial goals, you’re more likely to make conscious spending decisions that align with those goals. For example, if your goal is to save for a deposit for a house, then you may think twice about taking a vacation and instead put that money towards your savings. Setting and sticking to your budget gets a whole lot easier when you know what your priorities are.

Setting financial goals will also help reduce your stress and anxiety around money. If you have a clear plan for your finances, you’ll be less likely to worry about whether or not you will be able to pay rent or have enough to retire. The answer will be made very clear in your planning.

If your priorities aren’t in check or you have financial stress, then these goals will also serve as motivation to help you take action. That’s because having a clear goal in mind makes you more likely to take the necessary steps to achieve it. For example, if your goal is to pay off credit card debt, then you may choose to increase your income by getting a part-time job or starting a side hustle.

What’s the difference between long-term and short-term financial goals?

While the time ranges can differ depending on who you speak to, at Franc, this is how we define different investment goal timeframes:

- Short-term financial goals: You need to access that money in the next 0-3 years. An example might be saving for a holiday you want to take next year.

- Medium-term financial goals: You’re likely going to need to spend that money in 3-5 years, for example for a house deposit to put down in 4 years’ time.

- Long-term financial goals: Your money can be stashed away and growing cumulative interest for 5 or more years. This covers your wealth-building and retirement-based goals.

What Are SMART Goals?

Not all goal-setting is created equal. The SMART framework helps you structure your goals in a way that is more likely to lead to success, and stands for goals that are Specific, Measurable, Attainable, Relevant, and Time-bound.

Non-SMART goals are often too general and lack specific details and a sense of urgency which may lead to procrastination and a lack of motivation. With SMART goals, you have a clear roadmap to follow and can adjust your plan as necessary to stay on track.

To set SMART financial goals, follow these steps:

Specific: Make sure your goal is specific and clearly defined. For example, if you want to save towards a car make sure you know which car it is. This will make a big difference to how much you need to save.

Measurable: How will you measure progress towards your goal? What does success look like? Make sure you can easily understand how far you are to achieving your goal – it will help keep you motivated.

Attainable & Realistic: Ensure your goal is attainable and realistic. This is where your budget comes in: can you afford to put away R1,000 a month for your next vacation and still pay all of your bills without going into debt?

Time-Bound: Give yourself a deadline for achieving your goal. It will help create a sense of urgency for yourself.

With these 5 aspects in place, you will be able to regularly review your progress and adjust your plan if necessary.

5 Tips to help you stick to your goals

Aron Samuels has guided many clients towards achieving their financial goals. Here are his 5 top tips to making it happen for yourself:

- Work out what you need to sacrifice. If you already had the money you needed lying around, you probably wouldn’t need to achieve your goal. “The money you want to save is currently going elsewhere. It needs to stop going there now,” says Aron. Achievement requires sacrifice, so work out what you’re willing to sacrifice.

- Colour in the picture. “Humanise your goal: it makes it more real and difficult to disappoint. If you want to buy a car, ask yourself: what car? What dealership are you going to buy it from? What colour? How much is it? Get into the nitty gritty of it,” says Aron.

- Answer this: is your goal really yours? “For some of the things we want, especially the material things, we don’t always investigate why we want those things,” says Aron. Be careful that you’re not influenced by outside pressures that make you think you ‘need’ something that actually isn’t important to you.

- Share your goal with others to keep you accountable. “I always say there’s a lot of overlap between fitness and money. When you pay for a personal trainer, you’re going to show up. If you know your accountability partner is waiting in the gym parking lot, you’re going to go,” laughs Aron. Find a financial accountability partner to help you meet that goal (maybe through a Shared Goal).

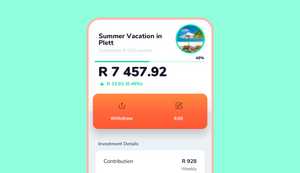

- Keep your savings separate. “It’s good to know yourself. Some people need to hide money from themselves, and that’s okay,” says Aron. “If you know you’re that person that’s going to be transferring from your savings account to your current account, you need to keep it separate. That’s why the Franc app is so cool: it’s totally separate from your day-to-day money.”

Need some financial goal inspiration?

Here are some financial goals from our Franc investors that are great examples of colouring in the picture and visualising your goal:

“I am saving money for job hunting and my graduation in May 2024. I am currently doing my final year and I have a lot to do next year, like finding the best outfit for my graduation and also transport money for the interviews of job hunting.” Nokuthula

“On the Franc app, I’m saving towards starting my own beauty business. I love everything beauty and would love to open my own beauty spa or salon.” Palesa

“My only hope and dream is to buy a home for my kids. A home for future leaders. We have moved more than 10 times and I believe that will bring stability in their lives.” Matome

There you have it, setting financial goals helps you prioritise spending, reduce your money-related anxiety and find the motivation to improve your financial situation. Once you’ve set SMART goals to take control of your finances and implemented a few of Aron’s tips into your money management, you’ll be set for goal-setting success.