A friend of mine recently reached out, asking for recommendations on budgeting apps. It got me thinking: we’re all in the thick of that New Year, New Me buzz – you know, the time when we've set our ambitious goals for the year and we really want to stay committed to them. For many of us, this journey involves making better and more informed money decisions.

Luckily for us, navigating this financial path has never been more exciting, thanks to the many apps designed to simplify our financial experiences.

Whether you're looking to build that emergency fund, trim unnecessary expenses, or venture into the world of investments, there's an app for really almost anything.

So, grab your coffee and let's chat about some financial apps that are going to make your financial journey a whole lot smoother.

Here are our 5 top financial apps to help you manage your money:

- 22Seven for budgeting

- Franc for investing

- Splitwise for sharing expenses

- Clearscore for tracking your credit score

- Snapscan for paying on-the-go

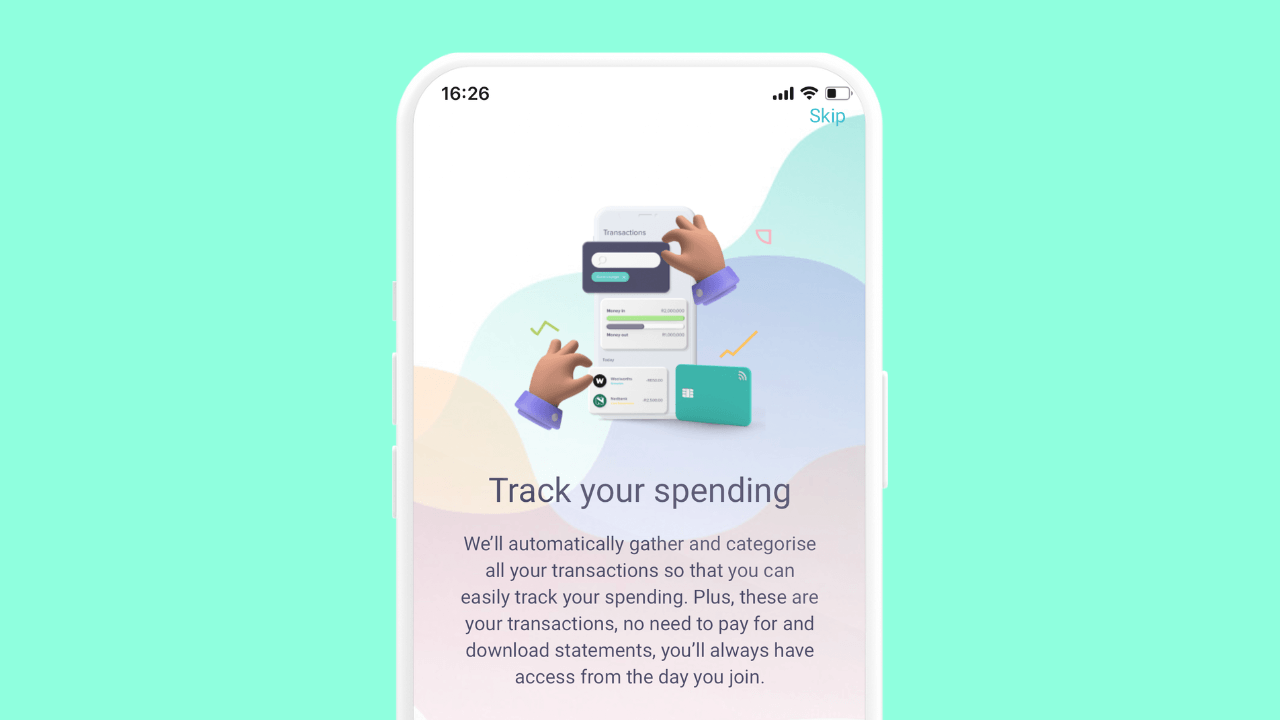

Best App for Budgeting: 22Seven

What it helps you do 📲Streamline your financial management and budgeting without the need for spreadsheets.

How it works ⚙️22Seven connects easily and securely to all your bank accounts, credit and store cards and investment accounts (without being able to transact on your behalf), and keeps track of your expenses, investments and debt. It’s the best way to track your expenses to see where your money actually goes each month.

Available on iOS App store, Android Play store and Huawei App gallery.

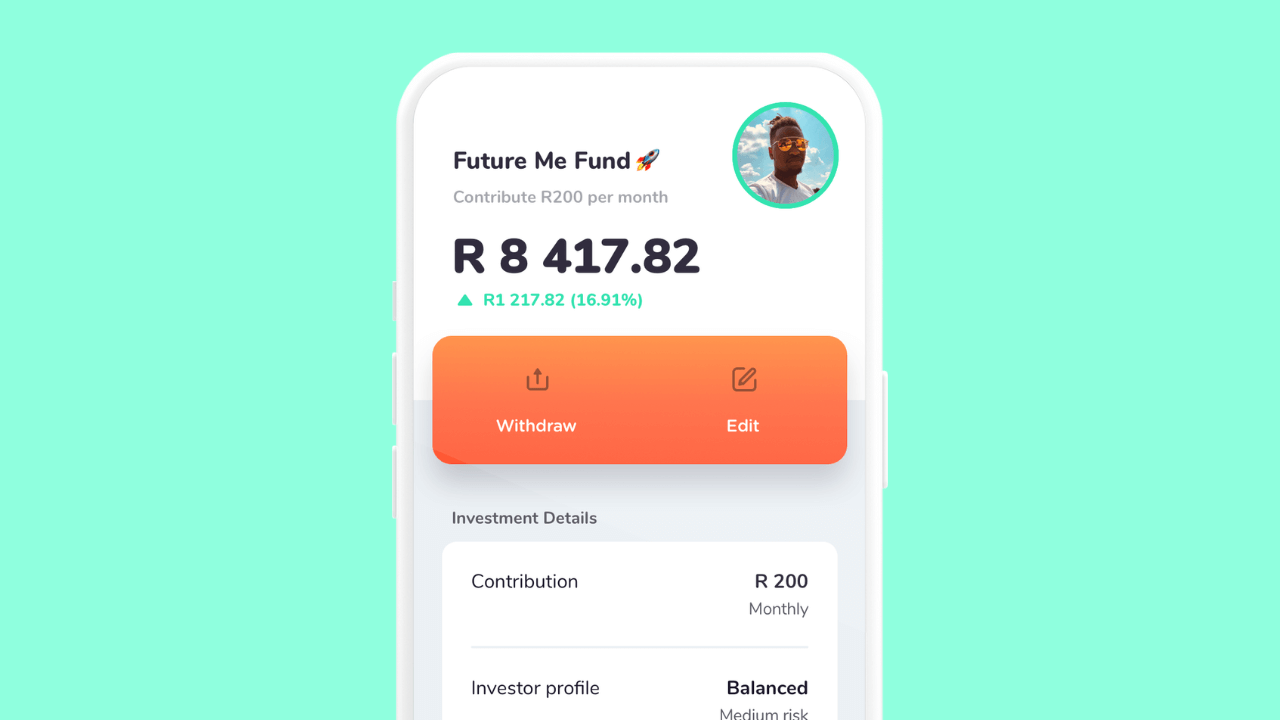

Best App for Investing: Franc

What it helps you do 📲Ideal for those looking to dip their toes into investing without the headache that comes with overwhelming investment fund choice and complex financial jargon.

How it works ⚙️Franc makes the investment process super easy and intuitive by allowing you to set your financial goals, get a recommended investment strategy based on your risk tolerance and timeline, and deposit into your investment goal, all in one app.

Whether you want to save for an emergency fund, buy a house or go on holiday with friends and family, the app gives you access to top cash and equity funds and makes monitoring your investment and the progress towards your goal very easy.

Available on iOS App store, Android Play store and Huawei App gallery. There’s also a web app option.

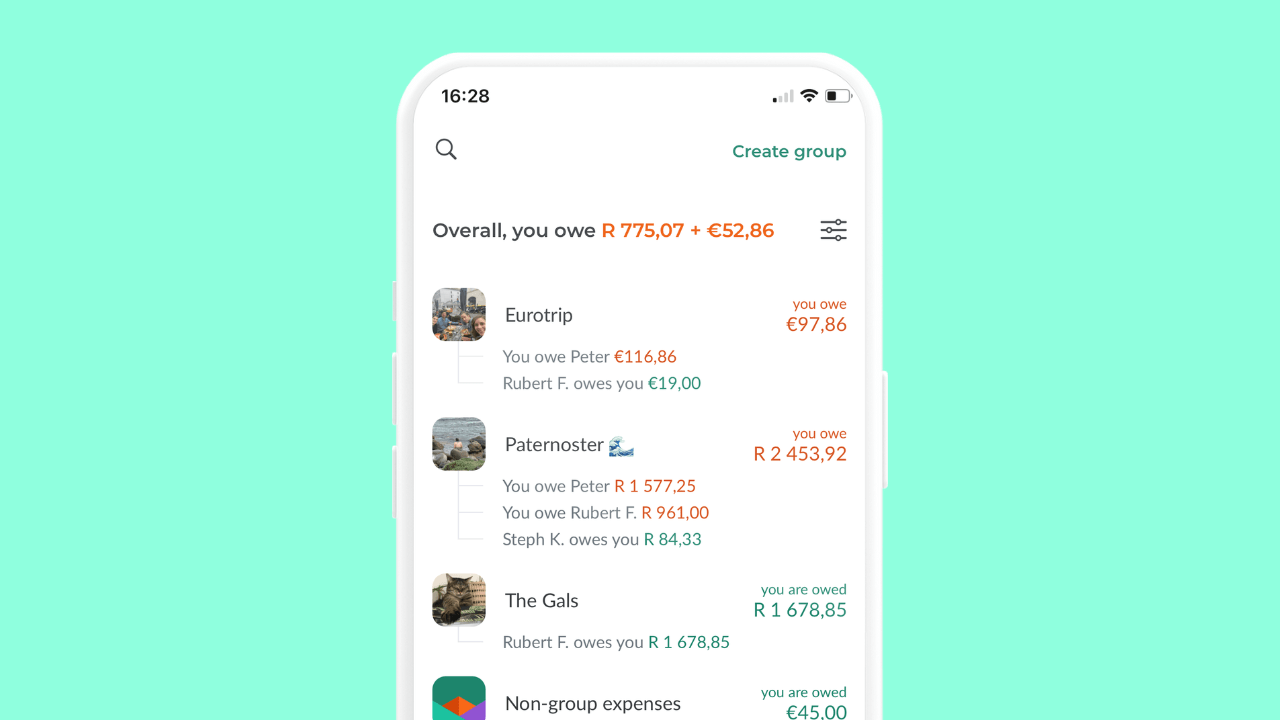

Best App for Shared Expenses: Splitwise

What it helps you do 📲 This app is a game-changer for those who share expenses with friends, family or flat mates.

How it works ⚙️Splitting bills and asking for money back can be extremely awkward. Splitwise helps with this process by dividing bills and keeping track of money owed, ensuring that everyone pays their fair share without the need for awkward conversations or chasing down friends for reimbursement.

Available on iOS App store, Android Play store and Huawei App gallery.

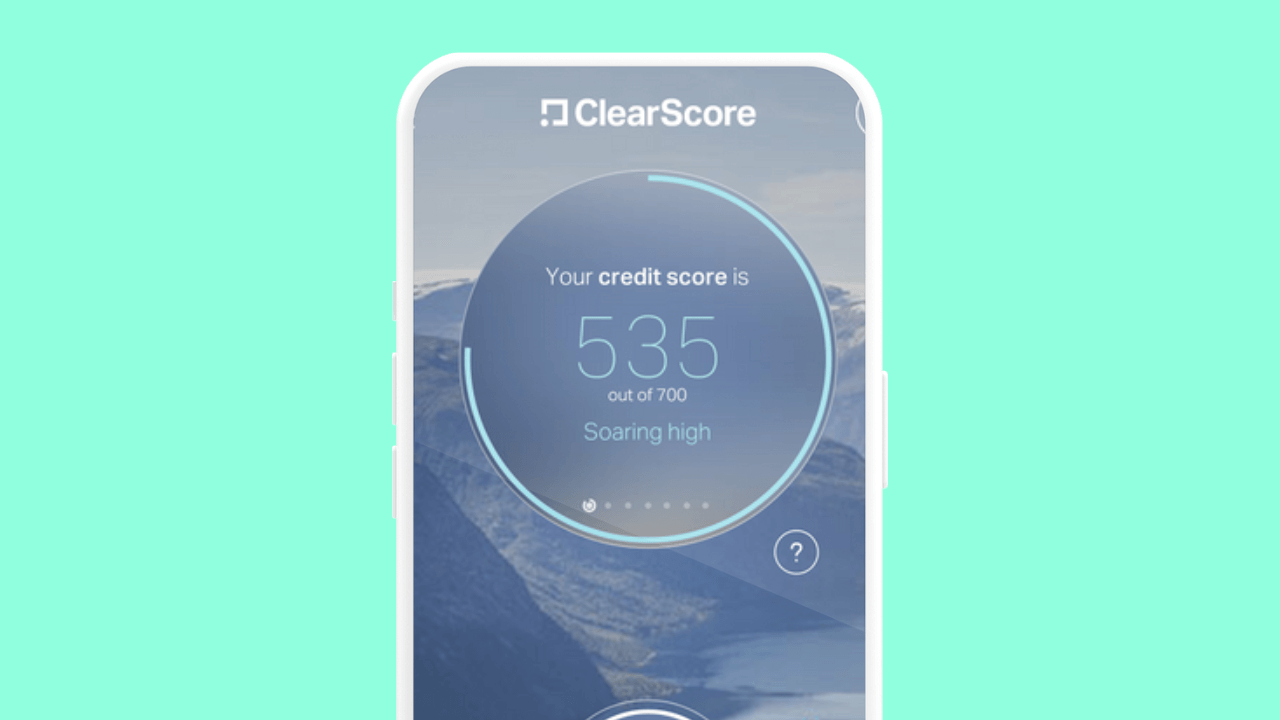

Best App for Credit Scores: Clearscore

What it helps you do 📲It helps you stay on top of your credit score and financial health.

How it works ⚙️ The Clearscore app provides free access to your credit score and detailed credit reports with information about any open accounts, payment history and other factors affecting your credit score.

Available on iOS App store, Android Play store and Huawei App gallery for free.

Best App for Paying On-The-Go: Snapscan

What it helps you do 📲Pay or receive payment from your phone without the fuss of handling cash, cards or EFTs.

How it works ⚙️ Snapscan utilises a QR code system. When you need to pay, you just scan from the app on your phone and authorise the payment from your card that’s already loaded. If you’re a small business owner or have a side hustle, you can sign up for a unique QR code for your business and have it displayed physically, or integrated into your e-commerce journey.

Available on iOS App store, Android Play store and Huawei App gallery.

Managing money has never been more accessible, thanks to the financial apps we have available in the palm of our hands today. So, whether you're looking for a new app to budget, want to kick off your investment journey or you’re simply someone wanting to stay on top of your finances, consider downloading these apps onto your phone. Here's to a financially savvy and prosperous year ahead!

![Planning Your Wedding Budget & Checklist [+ wedding budget template]](/blog/content/images/size/w600/2024/01/The-happy-couple-on-their-wedding-day.png)