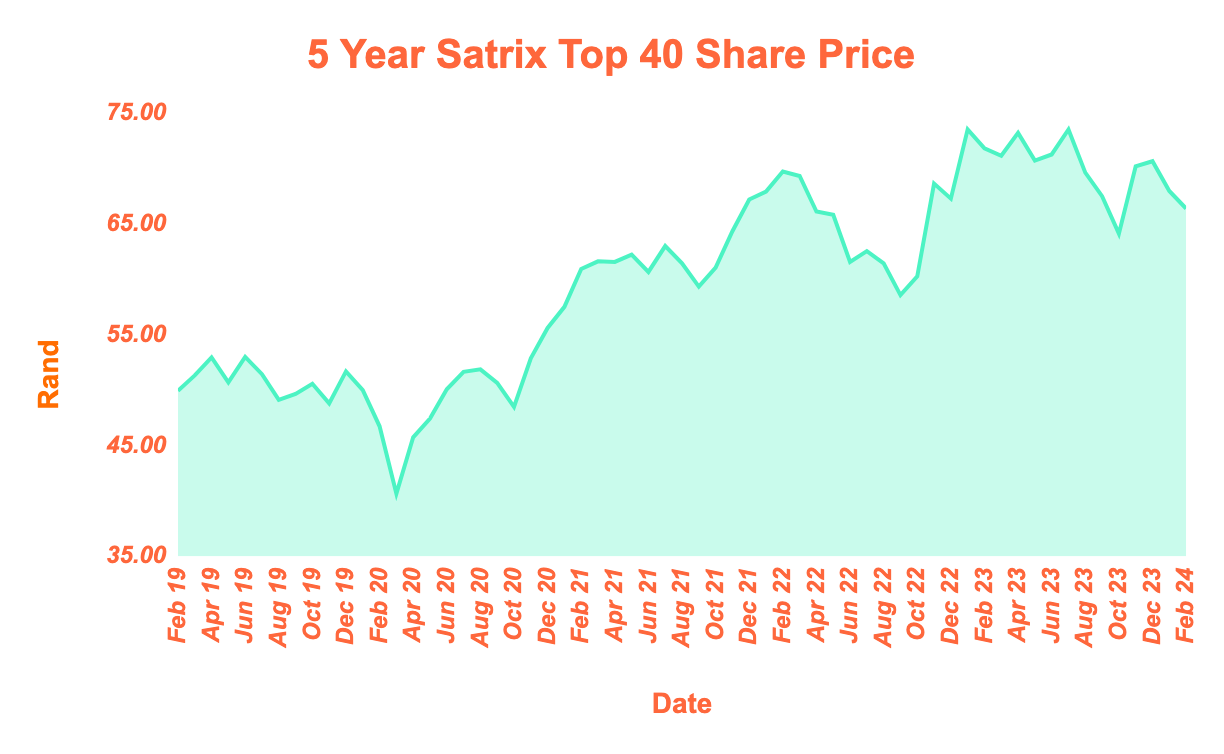

The lowdown: On the 29th of February, the Satrix Top 40 ETF closed at R66.39. That’s a 2.3% decrease over the past month (R67.97), and a 7.5% decrease from 28th February 2023 (R71.74)

The analysis: Looking at it month-on-month, the top 40 companies on the Johannesburg Stock Exchange (JSE) did not take the leap forward that we had hoped for during the 29 days of February. The majority of companies (25 out of 40) were in the red this month – not out of love.

Satrix Top 40 ETF Top Performers vs. Bottom Performers

Let’s look at the performance of the top- and bottom-performing Satrix Top 40 companies’ shares to understand the decrease over this past month:

Top-Performing Satrix Top 40 ETF Companies in February 2024

The biggest winner this past month, for the second consecutive month, was Richemont. The Swiss-based global luxury goods company share price increased 9%. Richemont experienced growth in sales in the challenging US market that helped offset a decline in sales in Europe. Richemont’s strategic focus on the higher-priced luxury sector proved advantageous, as middle-class consumer spending decreased, which has hampered other companies' brands.

It was another impressive month for NEPI Rockcastle as just when the market thought things couldn’t get any better, NEPI Rockcastle’s shares increased a further 9%. This was due to the East European mall owner delivering another set of stellar results.

Another winner this month was AngloGold. The gold mining company experienced a 7% gain during February. This gain can be attributed to a huge gold resource discovery (more than 250,000kg worth) in the US. The market welcomed the news with shares in AngloGold spiking towards the end of February. In addition to the discovery, increased gold production in the second half of 2023 helped ensure their golden performance this month.

Bottom-Performing Satrix Top 40 ETF Companies in February 2024

February was another painful month for the precious metals producer Sibanye-Stillwater, as their share price fell a further 13%. This decrease can be attributed to a R47.5 billion impairment, due to falling palladium, platinum and nickel prices. When it rains, it pours, especially for Sibanye-Stillwater, as a result of the impairment, the mining company expects to report a major loss next month. It has been pouring for 2 years now as Sibanye-Stillwater’s share price is down 70% during this period.

Poor platinum group metal (PGM) prices aren’t only affecting Sibanye-Stillwater, but also the likes of Impala Platinum (Implats), Anglo American Platinum (Amplats) and South32, whose share prices are down 12%, 8% and 12% respectively. Plunging PGM prices are affecting the entire mining industry as the trend of plummeting profits and job cuts continue.

Another company on the wrong side of things is Woolworths. Woolworths share price is down 8% this past month as shoppers spent less than expected. As a result, earnings for the half year, ending December 2023, fell more than 7% compared to the previous year. Furthermore, continued load-shedding and logistics issues limited the food, fashion and beauty products retailer’s performance.

No valentine for the Satrix Top 40 this February

Despite the underwhelming performance in 2024 thus far, remember that investing in the equity market is a long-term practice and month-to-month fluctuations can be expected.