What’s an investment return?

The primary reason why people invest is to grow their money; so that what they have in their investment after a certain period of time is more than what they put in. Any growth on your money is regarded as the return earned.

What’s the best way to compare returns?

Returns shown like this in absolute terms can be useful but in order to better understand and compare returns they are normally expressed in a return per year – or annual return – format.

In the example above, we don’t say how long the person invested for. If the return of 10% was earned over 5 years, it would be way less impressive than if it was made in a year.

When comparing returns of different investments or asset classes, it’s then appropriate to say over what period the investments are being compared.

Balancing risk vs. return

If you want to grow your money, surely then you want to earn the highest potential return? Why wouldn't you want to invest in something that could earn you 20% a year rather than something that is more likely to give you 6%?

Well, as we explained in a recent blog post about investment risk, you also need to take the risk of your investment into account. The higher the expected return of your investment, the more risk you need to take on. This means that the purpose and time horizon of your investment may play a big role in determining where your money should be invested:

1. Considering time horizon in risk vs. return

If you want to build up an emergency fund which you could access quickly if you needed to, then it makes sense to keep it somewhere where you could earn a stable return that doesn’t fluctuate much, but keeps up with inflation (things getting more expensive over time). You don't want to have to make a withdrawal from your share portfolio when the stock market has just plummeted.

That's why shares are not the best place for an emergency fund – we recommend using a low-risk money market fund for this purpose. Over the past 5 years, the Allan Gray Money Market Fund has offered a return of 6.5%, which beats inflation of 5.1% (so your money doesn’t lose value over time).

While this is a good return, it’s much lower than the return we’ve seen on our equity funds on the Franc app in the last 5 years. Over the past 5 years, the Satrix 40 ETF has returned close to 10% a year, whilst the Sygnia Itrix S&P500 ETF has returned closer to 20%.

However, as we’ve mentioned already, with high returns comes higher risks. Both these investments had periods where they went down drastically. For example, when Covid hit, these funds lost 20% in a short period of time.

That’s why investing in equities is more appropriate for long-term investing – if you want to grow your wealth so that you can retire comfortably, for example – you can afford to take on some investment risk in order to build up that nest egg.

2. Considering purpose in risk vs. return

Besides the risk of an investment, the other thing to take into account is the liquidity of the investment.

Liquidity and potential return sometimes go hand in hand (but also sometimes, don’t).

For example the money sitting in your bank current account is very liquid (and earns very little, if any, interest) whereas a property is an extremely illiquid investment but could earn you a good return over time. So this is an example of where high liquidity means a lower return.

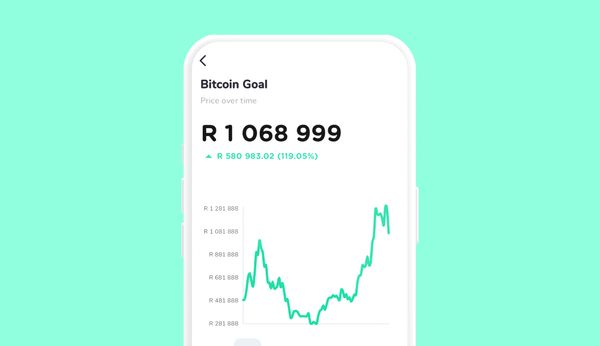

On the other end of the scale, cryptocurrency like Bitcoin is very liquid but could earn (or lose!) you a decent chunk over a short period of time. A fixed deposit is not liquid at all during the period of the investment and the returns are unlikely to be too exciting. So highly liquid doesn't necessarily mean low return (and vice versa).