The famous (or infamous, depending on who you ask) Twitch streamer and cryptocurrency investor sadly passed away just under a year ago on the 24th of November 2021. On his Twitch streams, Mr. Goxx would give advice on which cryptocurrencies to buy and sell, and when to do so. If you had tuned into those streams and followed his advice, your portfolio would have gone up by nearly 20% in four months, beating investing legend himself, Warren Buffet. So how did he manage to do this?

Well, you first need to know that he was an avid runner. Mr. Goxx exercised daily before making a trade decision. But perhaps, more importantly, you should know that Mr. Goxx was… a hamster (insert record scratch). Yes, that’s right. The investor and streamer extraordinaire who beat the FTSE 100, Dow Jones, and Berkshire Hathaway was trading out of an office with a hamster wheel and cardboard cut-outs of monitors.

I have instructed my human business partner to get me a decent computer setup for my office. Best of all: It's safe to eat 🐹 #hamster #Crypto #CryptoNews #trading pic.twitter.com/O3kXJjXV9Y

— Mr. Goxx (@mrgoxx) July 16, 2021

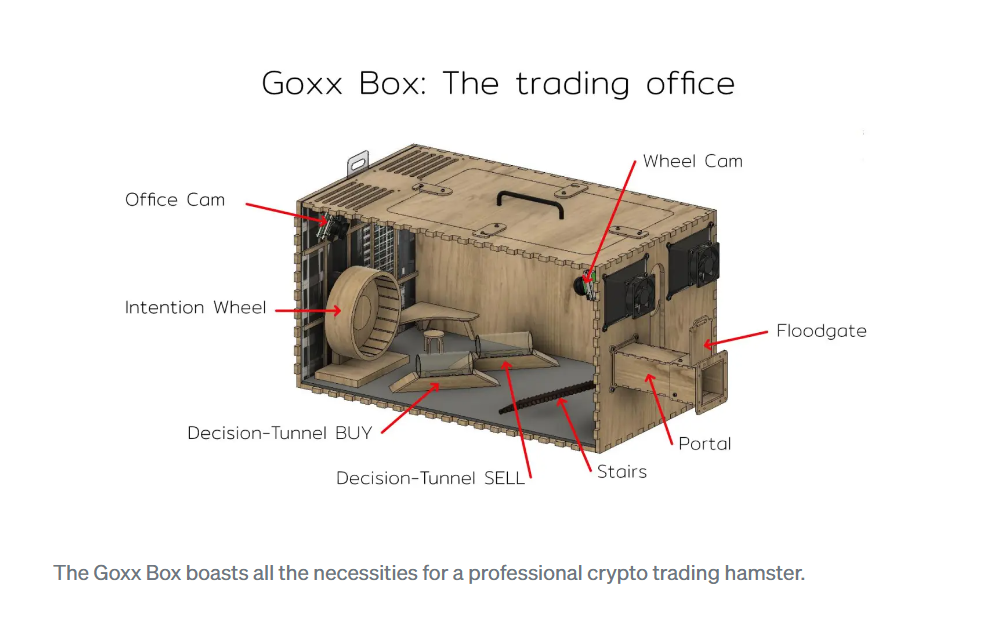

This may seem confusing - how does a hamster trade, let alone outperform major funds? The answer to the first part of the question is simple enough. Mr. Goxx’s trading office (The Goxx Box) had a hamster wheel called the intention wheel. It worked similarly to a lotto wheel, which meant that when he stopped running and the wheel stopped spinning, one out of thirty cryptocurrencies would be chosen to trade with. When he got off the wheel, he’d run through one of two tunnels; a BUY decision-tunnel and a SELL decision-tunnel. If for example, he got off the wheel and it stopped on Bitcoin, and then he ran through the BUY tunnel; the trade would be to buy Bitcoin. Sometimes he’d run through the BUY tunnel and run through the SELL tunnel a moment later, in which case the trade would be to buy Bitcoin and then sell it again. Foolproof.

The answer to the second part of the question is slightly more complicated though. Again, depending on who you ask, Mr. Goxx could’ve been a genius hamster or he could have simply been winning a few gambles. Believing the former implies that to some extent, Mr. Goxx was able to make predictions that take some traders years to perfect. Which sounds really cool and maybe really dystopian too. Don’t worry about the robots taking over jobs, just worry about the hamsters. Though, this was probably not the case (no disrespect to the mind of Mr. Goxx). The alternative hypothesis? Perhaps when trading crypto, a bit too much is left to chance. And, the higher the uncertainty of the outcomes of your trade, the further away you move from investing and closer to gambling. Which makes Mr. Goxx less of a prodigy, and puts him more in line with the likes of Paul the Octopus (the octopus that correctly predicted the results of Japan’s 2010 World Cup group-stage games).

Investors with higher-risk appetites wouldn’t be as phased by this. But if you - like me - are looking for security in your returns rather than the occasional chance at really high returns, then it’s worth simply admiring the story of Mr. Goxx and moving on. Crypto’s volatility makes it difficult to predict which day you’ll be unlucky enough to lose 30% of your investment. So maybe stick to your ETF for a safer and more sustainable investment. We can’t promise you Mr. Goxx’s magic touch, but invest in the SATRIX Top 40 ETF on your Franc account to take advantage of returns that don’t come at the cost of the fund manager’s health (RIP Mr. Goxx).