In the era of Bitcoin and online forex trading it's easy to lose track of the difference between investing and gambling.

We all know that gambling is a high-risk activity. The phrase "it's a gamble" refers to things that are uncertain and dangerous.

When we gamble – or take a chance – we usually accept that the odds are against us, that there is more chance of losing than winning.

When you buy a lottery ticket you expect to lose your money; the only reason you keep buying those tickets is that there is an outside chance, albeit very remote, that you'll win big.

But what does this have to do with investing?

Blurred Lines

"Ya, but the share market is really just a gamble, isn't it?"

This is the kind of statement we hear quite often at Franc when we talk to people about investing.

And this is why it's very important to understand the difference between investing and gambling. How do you tell them apart?

The difficulty is that so many people say so many different things.

You hear about shares that went up 50% overnight – or down 50% overnight. You hear that Bitcoin went down 20% in one day – and then shot up 20% in one day. Some people say Bitcoin is a gamble, others say it's an investment. Some people say shares are a gamble rather than an investment.

Who do you believe?

Characteristics of Investments

We've already described one of the prominent features of a gamble – namely, you're unlikely to "win", unlikely to get anything back, more than likely to lose the cash you put down.

What are the things that characterise an investment?

1. Zero chance of losing all the money you have invested.

2. A very low probability of losing money over the medium- to long-term.

3. A good chance of a positive return over the medium-term.

4. A very high probability of a reasonable return over the long-term.

5. An asset with intrinsic value that generates income and capital growth.

Think about the above points in relation to property. A house might go down in value but it will never suddenly lose all its value. Over time, in general, property prices go up – which means a positive return. Over the long-term – as you pay off the bond and the transaction costs are spread over a longer period – the chances of a reasonable return increase. And finally, the house represents a tangible asset that could generate income if you were to rent it out.

Shares in listed companies have similar characteristics – which is why, on the whole, the share market is not a gamble, especially when you buy shares in profitable companies with well-known products. When you buy shares you become part-owner of an established business – that's very different from buying a lottery ticket.

A single share can be a gamble, just like buying a house in a bad area can be risky. But a portfolio of shares spreads the risk and reduces exposure to any one company that takes a knock.

This is called diversification. It works in the property market too, but it's easier to buy ten shares than ten houses all over the city.

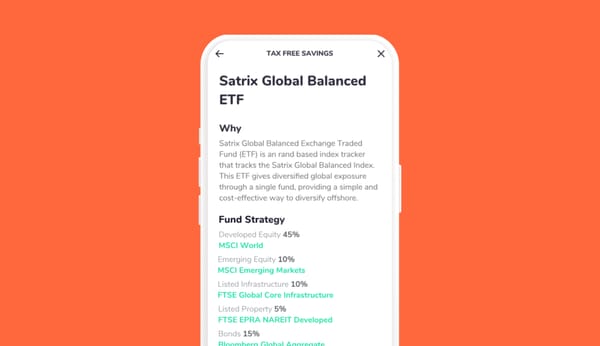

The reason we favour broad-based ETFs (Exchange Traded Funds) at Franc is that they automatically provide a high degree of diversification, giving you the best the share market has to offer while reducing the risk associated with individual shares.

Odds and Rates of Return

Gamblers talk about odds. Investors talk about rates of return. The differences and similarities are interesting and instructive.

At the horse races, a really strong favourite might have odds as low as 2 to 10. This means that if you bet R10 and the horse wins you get R12 back. In investment terms, that's an instant return of 20% – very attractive compared to houses and shares.

The problem is that favourites only win about a third of the time, so you have, at best, a 1 in 3 chance of winning. And if you keep betting R10 on every race but only get back R12 on every third bet… you're losing R18 out of every R30!

The point here is that "odds" start at "instant" returns of 20%… or 50%… or hundreds of percent. Investments typically top out at returns of 20% per year.

In other words, if you haven't got time to study the characteristics of an opportunity, just look at the touted annualised return. If it's more than 20% a year on average you should be very cautious. If it's a very quick return – days or weeks – there is almost certainly a high degree of risk.

In the world of investments we are looking for the "sure thing." While there is always some risk, global stock markets have, on average, provided double-digit annualised returns for at least half a century – provided you stay invested.

It's a bet where the odds are stacked in your favour, not against you. All you need to win is patience.

![How & Why You Should Do a Financial Reset [+ downloadable financial reset journal]](/blog/content/images/size/w600/2024/12/Setting-goals-for-the-year.png)