On the South African government website, Heritage Day is described as a day which "recognises and celebrates the cultural wealth of our nation. South Africans celebrate the day by remembering the heritage of the many cultures that make up the population of South Africa." There's no doubt that there is much to celebrate in a country as diverse as our own. However, as we know there are lots of embedded issues that hold us back (and I'm not just talking about the rolling blackouts caused by Eskom's loadshedding).

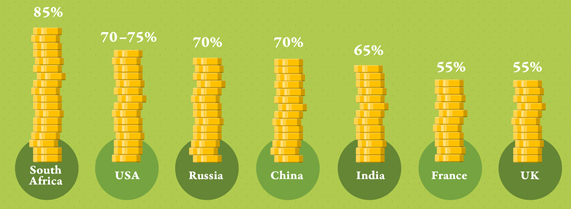

South Africa is often claimed to be the most unequal country in the world when it comes to both wealth and income inequality, with the discrepancy in wealth being even worse than that of income. The reasons for much of this are well known - our society was historically built on denying many of its people access to equal opportunities. However, a recent study showed that since the end of apartheid there is very little evidence to suggest that wealth inequality has reduced at all. The wealthiest 3,500 adults own more than the poorest 32m people in SA and have an average wealth of 1,500 times that of the average South African adult - both unbelievable statistics. Incredibly, the wealthiest South African (top 10%) own 85% of the country's wealth (see the chart below). The study showed that reforms such as affirmative action and BBBEE (companies having to have mandatory Black ownership), have not done much to narrow the wealth gap.

A recent study by the World Bank ranked South Africa as the most unequal country of the 164 in the World Bank poverty database. The study showed that one-fifth of inequality in Southern Africa is explained by inherited circumstances such as location, gender, age, and parental background. When race is included in the analysis, the inequality of opportunity more than doubles. The lack of access to skills and assets such as land prevents the gap from closing.

Extremely high local unemployment, especially among the youth is another reason why inequality is perpetuated. Although the reasons for this can be linked back to underlying historical issues as well as failure of the education system and the poor performance of the economy in general.

One would also guess that the pandemic has impacted poorer people much more than wealthier ones. Those that were less resilient would have had to dip into savings (best case) or take out expensive loans in order to survive. Many lower-income and labour-intensive jobs would have been lost or had hours significantly reduced as they could not be completed from the comfort of one's home office.

French economist, Thomas Piketty, in his book "Capital in the 21st Century" argues that wealth inequality widens even more than income inequality over time. This is because the rate of return earned on capital is higher than that of labour. To put it simply, he is saying that money invested grows at a higher rate than your salary. If you had been invested in the JSE Top 40 for the past 20 years or so, your annualised return would be around 10% (excluding dividends received). Compare this with a salary - it is very unlikely you would have got a raise of 10% every year over the same period! So what does this mean? Well, it means that the rich are getting richer. Those with access to quality investment products are benefitting from higher returns. And in a country where less than 10% of the population invests and fewer than half of all households own the land on which they live it is unsurprising that inequality continues to widen.

At Franc we want anyone and everyone to be able to access quality investment products so that they too can benefit from growth on their capital. Not enough South Africans have investments outside of their retirement savings. The reasons for this are wide ranging - some just don't have the money, others are intimidated by the options out there or excluded by the high minimum investment requirements. These are the barriers we are trying to overcome so that we can do our small part to close the gap.

![What's the Level of Financial Literacy in South Africa? [+ financial literacy quiz]](/blog/content/images/size/w600/2023/09/financial-literacy.png)