I think most people have wondered what it would be like to be a millionaire. Whether it's winning the lottery, becoming famous or launching a wildly successful company.

Most people, sadly, don't think of investing as a way of becoming a millionaire. Probably because most people think investing is too complicated and only for people with lots of money.

The reality is that investing is one of the most reliable ways of becoming a millionaire. The principles of successful investing are actually extremely simple: start early, invest as much as you can in low-cost, high-performing assets, and be patient.

Let's unpack each of these principles in turn.

Why is it important to start early? The simple answer is that it takes time for compound growth to work its magic. Compound growth is when investment returns are reinvested thereby compounding the growth over the time. It's because of this phenomena that your investments can start working for you literally while you sleep.

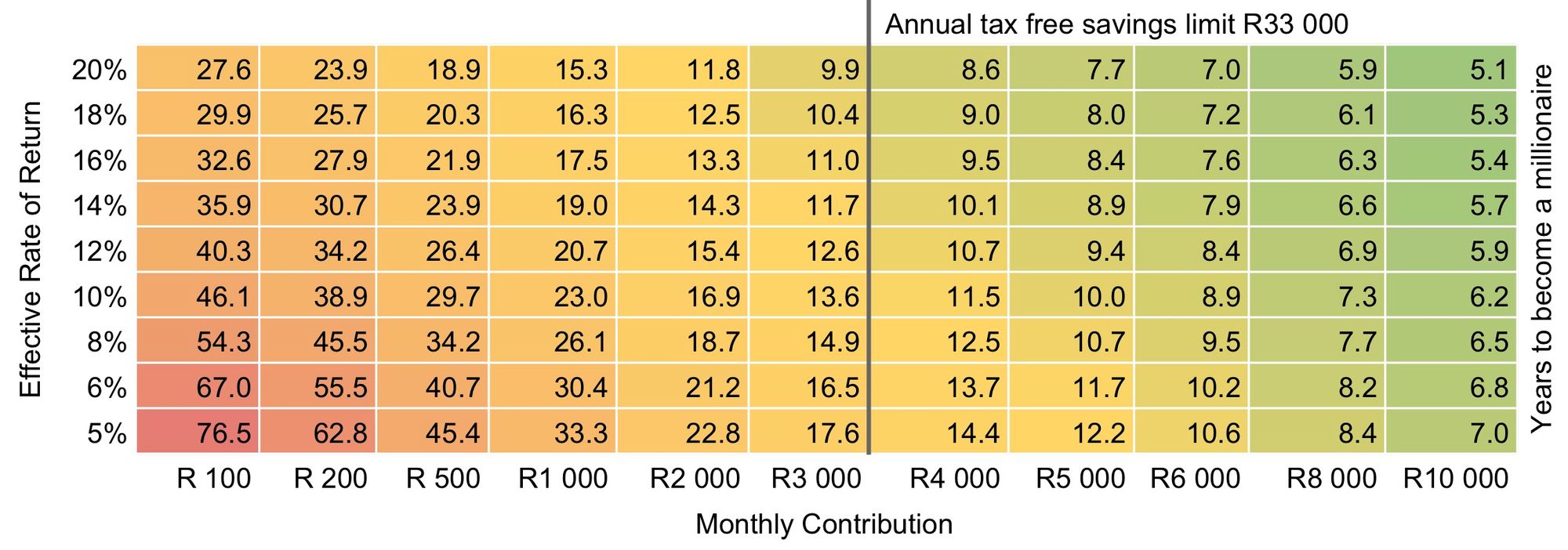

So what would you need to invest to become a millionaire? To show how achievable it is we worked out how long it takes to become a millionaire for various monthly contributions using a range of investment returns – from savings account rates to the upper levels of equity market returns.

Even at just R200 a month it is possible to become a millionaire in not much more than 30 years based on typical long-term stock market returns* – therein lies the power of compound growth. If you can afford to save R2 000 a month you could be a millionaire in less than half that time.

This brings us onto the second principle – putting your savings into low-cost, high performing investments. The reason why this is so important is because it's essential to beat inflation. Inflation erodes investment returns and means your money loses value over time. If inflation is 5% and you're earning 5% in an investment account your money hasn't grown at all in real terms – now that's a scary thought!

Like inflation, fees also have an eroding effect on your investments – they effectively eat away at your investment returns. So for example, let's say you invest in a unit trust that costs you 2% a year in fees** – this means that an effective annual return of 7%, after fees, is only giving you 5% a year growth, which again means your money won't grow at all in real terms. This is why it's so important to consider both the cost and performance of your investments.

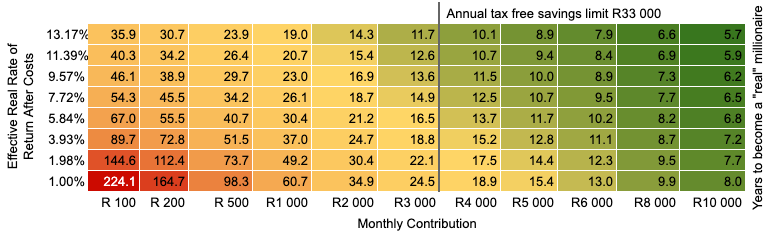

If we relook at our analysis of how long it takes to become a millionaire in real terms assuming inflation of 4% a year and costs of 2% per year, the outlook changes somewhat:

If you invest R200 a month, after costs and inflation and based on typical long-term stock market returns*, it will now take more like 45 years to become a "real" millionaire – in other words, to save a million that has the same spending power as a million today.

To put it another way, the situation now for a R200 a month investor is that an investment like Berkshire Hathaway is needed (Warren Buffet's investment company, which has historically annualised returns of 21%) to become a "real" millionaire in 30 years – such investments are not easy to find. But the power of compounding means that by saving R500 a month you can become a "real" millionaire in around 34 years based on typical long-term stock market returns*.

Which brings us to our last and perhaps most important principle – patience. The reason is three-fold. Firstly, as discussed, compound growth takes time to deliver results. Secondly, impatient investors tend to buy and sell their investments frequently, usually selling at the wrong time and paying additional transaction fees that eat into returns. And thirdly, impatient investors tend to raid the piggy bank – withdrawing money undoes the effects of compounding.

So the principles for smart investing are actually simple: start early, invest as much as you can in low cost, high performing assets, and allow compounding to work its magic (patience), saving a million is a feasible objective.

*The long-term rate of return (including dividends) for the JSE All Share Index is around 15% p.a. since 1960 but we've assumed a slightly lower rate (14%) in order to be conservative.

**This assumes average total costs of SA General Equity funds (around 1.5% a year) plus 0.5% annual advice fee. Many funds have higher costs than this.