Having a financial plan is perhaps the most important component of adult life. But most people don't know where to start in creating one. This is where financial advisors can help you. A financial advisor, or “broker,” is a licensed professional who provides advice on various aspects of financial planning and personal finance. Like most professionals, financial advisors usually have areas of specialisation – such as investments, insurance and medical aid or a combination of both.

Trained financial advisors can help individuals and organisations achieve their financial goals by designing strategies and recommending products that create wealth, reduce costs and eliminate debt. Sadly, gone are the days when your financial advisor was a family friend. These days, most brokers are incentivised on a commission basis, which means that there is a tendency to service the wealthy and sell products that pay the most commission, which are often the most expensive products that will eat into your return.

Some advisors use a fee-for-service model where they charge a flat fee for their advisory and consulting services. Sometimes the initial consultation is free, with follow-up consultations and resulting recommendations charged at a fee. Fee-for-service aligns the interest and is therefore the recommended incentive structure, because if you’re happy with the service offered you will be most likely to recommended the advisor’s services to friends and family.

But before we get ahead of ourselves let’s start at the beginning.

Do you need a financial advisor?

The honest truth is that unless you’re already wealthy and have a complicated personal financial situation, you probably don’t need a financial advisor. The majority of ordinary people, especially younger people, will not get good advice and will likely be sold expensive products they don’t need.

Think about it – if you have R1,000 a month to spend on financial products and the advisor’s commission is 3% they stand to earn R360 from your business over one year. A good personalised financial plan can take hours to design – and that’s over-and-above driving to the appointment, talking to the client for an hour or more, and answering questions over the phone explaining the many things that clients don’t understand.

The sad reality is that most brokers aren’t willing to spend time on clients with small budgets. Their recommendations therefore end up being, at best, no better than advice from a glossy magazine article, and at worst, expensive products that are not the best choice for the client but give the advisor the best commission.

What are the alternatives?

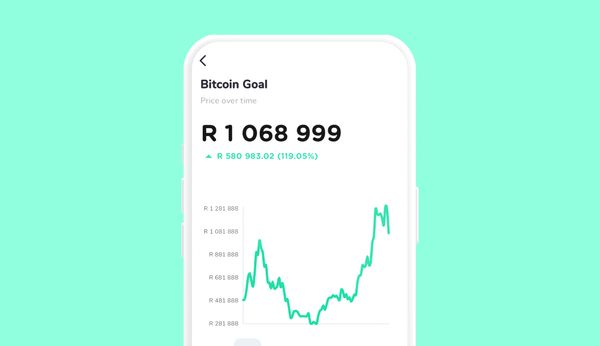

As technology continues to progress there are an increasing number of “robo-advisors” in the market. Robo-advisors are automated programs using advanced algorithms that can recommend a personalised investment portfolio tailored to your needs. Robo-advisors automate the process of collecting and interpreting information, meaning that they can complete the job of a financial advisor in a fraction of the time and at a fraction of the cost.

It’s important to know that each of your personal financial goals will likely require a different investment strategy. For example, an emergency fund is different from; buying a house, sending your children to school, or retiring.

When you’re young your initial imperatives should be building an emergency fund, getting into a good saving habit, and to start investing. If you have dependents or have recently bought a home you may also need life insurance and a hospital plan, but nowadays these things can also be purchased online.

Your emergency fund should be in a risk-free, high performance, low-cost money market fund, like the Franc Cash Fund. And the savings habit needs to be under your control, not a “contract” that locks you to paying a fixed amount every month. You should aim to have an emergency fund that is 3 to 6 times your monthly income.

When you start investing, a low-cost equity index tracking investment is your best option, like the Franc Equity Fund. As a rule of thumb you should be investing 20% of your monthly income on an ongoing basis. Invest and forget is the best advice to take onboard.

Where can an advisor help me?

Of course, there is a time and place for professional advice. For instance, you could talk to a financial advisor when you start a family, buy your first house or become a business owner.

The best financial advisors are in fact financial planning partners. Together, you will cover many topics, including the amount of money you should invest, the types of investment products that would be best for you, the kinds of insurance you should have, even retirement and tax planning. To do their jobs well, the first step is understanding your financial health. Financial advisors should be asking you the following questions to get a 360 degree view of your personal finances:

- What is your monthly income and what are your monthly expenses?

- Do you have people that depend on your income?

- Do you have children, or plan to in the near future?

- Do you already have a plan for your retirement and what are the details of that plan?

- Do you suffer from any serious health issues?

- How much debt do you have?

- What is your attitude and capacity to carry risk, both investment risk and personal risk?

Armed with an understanding of your financial situation, your needs and risk profile, the financial advisor will construct a personal financial plan and recommend products. The scope of the plan depends, obviously, on what you’re looking for: grow your wealth, prevent financial shocks, prepare for the future, or everything combined? It should also unpack the action steps required to execute the plan and milestones you can expect to achieve along the way.

It’s important for you, as the client, to understand what your advisor recommends and why – it’s your money after all. Here are a list of questions you can and should ask any financial advisor:

- Why were specific products recommended?

- What are the fees involved?

- What are the terms and conditions of the products?

- How will you be kept informed of the performance or status of the various products?

- How regularly should you update or revisit your plan to make sure it’s still the right combination for you?

- What happens if your personal financial situation changes, such as getting married or divorced, adding a child to your family, buying or selling a home, changing jobs, or getting a job promotion?

The Bottom Line

Having a well thought out financial plan is fundamental for everyone. It can help you plan for the future by managing your money in the present. Financial advisors can help you create a financial plan, but not all financial advisors are made equal so it’s important to find a qualified and experienced advisor who has a fee-for-service rather than a commission incentive.