Credit scores are notoriously tricky to understand and differ from credit bureau to credit bureau. It’s critical to get your credit score in a good place if you want to apply for a loan, and might even impact your job or rental application.

In South Africa, there are around 22.5 million credit-active consumers. 41% of these consumers are considered high-risk borrowers, and a further 15% of the consumers are considered very high-risk borrowers.

Given that there are around 38 million adults in South Africa, this implies that 41% of South Africans don't even have a credit score.

Why is this important? Because most banks won’t consider giving you a home loan if you aren’t in the top 35% of credit scores.

We chatted to Sean Rossouw, Founder and CEO at BenX, to get clear on how credit scores work and how someone can build one from scratch, or improve it.

Franc takeaways

- Your credit score – or creditworthiness – will be the make or break when it comes to getting a loan to buy a car or house, getting a student loan, getting a credit or store card or even qualifying for a cellphone contract.

- A credit report is what financial institutions – like banks – will use to measure your creditworthiness, approve a loan and decide on the interest to charge you.

- Credit scores and credit reports are produced by credit bureaus, who base this on your credit history and any debt you have left to pay.

- Credit scores can be improved by paying off any outstanding debts, removing any court orders against you and checking for errors on your credit reports.

What is credit?

Taking out ‘credit’ is an agreement (that often comes with a contract) between the person who’s borrowing the money (the borrower) and the person that’s lending the money (the lender). In most credit arrangements, the borrower agrees to pay the lender the amount they’ve borrowed (the loan) with interest.

There are two types of credit:

- Unsecured credit. In this case, the lender doesn’t have “back up” if you don’t keep up your loan repayments for any reason. In the case of unsecured credit, the lender makes the decision to lend to you based on your credit score and your promise. Because this is riskier for the lender (a promise only goes that far!), the interest rate on this kind of loan is often higher to cover the risk of the lender not getting paid back. Store cards, credit cards or personal loans are all examples of unsecured credit.

- Secured credit. This means you’re borrowing against an asset such as a home or a car. That means that if you default on your loan repayments – in other words, fail to pay – the lender can take your asset to collect the funds that are owed to them. Because of this “back up” for the lender, your credit score isn’t quite as important. A good credit score does help you to get a better interest rate or a higher loan, however.

For all types of credit, you’ll first make an application to the lender, who will then check your credit report before deciding whether to lend you money.

Understanding a credit report

Your credit report is what lenders and banks can request from credit bureaus: specialist companies that compile a wide range of information on you and use that information to put together a credit report to give you a credit score.

Lenders and banks will then use that score to decide whether or not to give you the loan or credit card that you’re applying for, and also help them decide on what interest rate they will charge you.

There are four main credit bureaus in South Africa: Experian, TransUnion, Compuscan and XDS. Every month, lenders send transaction details to these bureaus, who then compile the information into a credit report, consisting of a consumer’s credit history and habits.

How does your credit report affect you?

There are three ways a credit report will affect you:

- Your credit score affects whether you get credit in the first place. Whether you’re buying your first car or house, getting a student loan, applying for a credit card from your bank, or getting a cellphone contract, you’ll need to have a good credit record.

Your credit score or record will help these institutions make a decision on how likely you are to pay the contract amount or the loan back. - Your credit score affects interest rates on loans. Your credit score will also make a difference to the type of interest rate you’ll be offered on your loan. In general, the healthier your credit history, the better the interest rate you’ll be offered.

- Your credit score can affect your lifestyle opportunities, too. Although this is only legal if you’re applying for a finance-related job - more and more recruiters are looking to candidate’s credit scores as part of the recruitment process. It’s now also common practice for landlords to do a credit check on their tenant applications before you rent a place.

What is a good credit score?

Unfortunately, there’s no “magic” credit score that will guarantee that you get accepted for credit. Different lenders are looking for different things, so you might get refused credit by one lender and accepted by another.

Your credit score is just a useful indication of your creditworthiness, but lenders will look at other factors (like your income and debt) before deciding whether to lend to you.

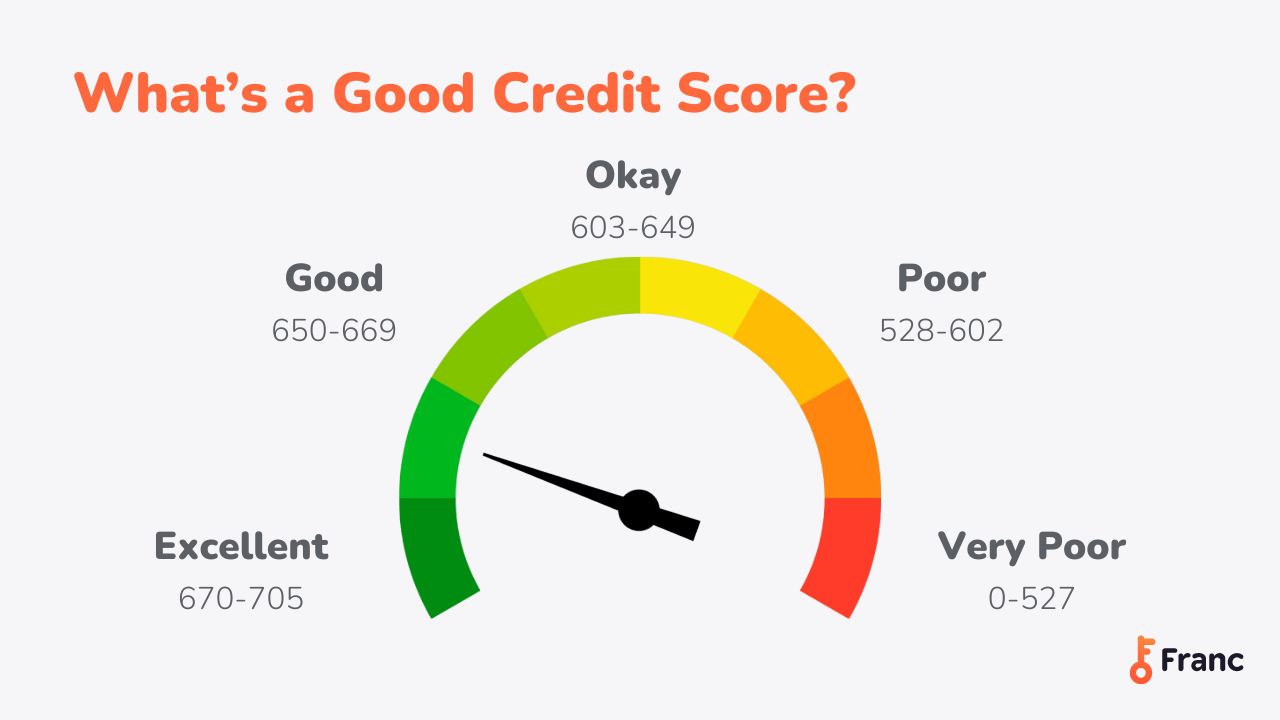

Having said that, here’s an indication of what’s a good credit score and what isn’t:

How to build a credit score from scratch

If you’ve just entered adulthood, started your first job, or you’re just new to the world of credit, it can be frustrating to start from scratch without a credit history (i.e. history of borrowing money). That’s because a lack of credit history is often seen by lenders as not being creditworthy; it’s a bit of a chicken and egg scenario.

It’s important for lenders to see a history of how you have successfully managed debt, no matter how small. Here are some ways to get you started:

1. Open a bank account

Managing your bank account well is a good indicator of your financial responsibility, which goes a long way in building a good credit history. If there’s an overdraft facility, you will benefit from activating that too, with a small limit to start. A good rule of thumb is to use no more than 25% of the available overdraft limit and pay what you owe every month.

2. Get a store card

One of the easiest ways to build your credit history is by getting a retail store account card. Use the store card to make small purchases and repay the money at the end of each month. Don’t go beyond your budget and keep your credit balance below 35% of your credit limit.

3. Get a credit card

Apply for a credit card with a limit of no more than 50% of your monthly salary. Use your card for small purchases and your monthly grocery shopping, making sure to pay off the money you owe at the end of each month. And like the store cards, don’t exceed 35% of your credit limit to start.

4. Apply to access the BenX CreditBuilder™

This innovative product helps you grow your credit score by making monthly payments towards a ‘loan’, but puts these payments into an interest-accruing money market fund (the cash fund on the Franc app). Once you’ve repaid the agreed-upon loan amount, you can withdraw your money or leave it in the money market fund to keep growing – but either way, you’ll end off with a better credit score and an emergency savings fund all saved up! Find out more about the BenX CreditBuilder™.

5. Monitor your credit report

By regularly checking your credit score, you can make sure you're keeping it as healthy as possible and pick up any signs of fraud, incorrect information or judgments against you. The quicker you pick up any issues, the quicker they can be resolved.

Improving Your Credit Score

If you’ve been working on your credit score for a while, but your credit score is low, it’s not the end of the world. There are ways you can improve it:

1. Pay off your accounts

Store credit, cellphone accounts, and bank loans – especially for other assets, such as a car – are a good place to start. Obviously it may be a lot easier to pay off a store card instead of a car loan, given the amounts involved. Credit card debt has a strong influence on your credit score so paying back your credit card balance every month can have a significant impact on your score.

2. Pay your bills on time

Paying what you owe every month, or even a little more, will help build a good credit score.

3. Check for court orders

Use your credit report to see if you have any black marks against your name and if you do, try to resolve these debts as a matter of urgency. The court order will be removed once the credit bureau receives proof of payment.

4. Check for errors

You can check your credit report for information that doesn’t seem correct, such as late payments that were actually paid on time. You can lodge these disputes with the credit bureau, and you’ll need to provide evidence in the form of supporting documentation. It usually takes 20 days for the credit bureau to investigate such disputes and correct the record.

5. Don’t apply for more than one loan at a time

Doing so will signal to lenders that your financial situation is deteriorating. Every time a financial institution checks your credit score to determine your creditworthiness, your credit score reduces.

6. Avoid spending up to your credit limit

Generally, you’ll want to keep your spending below a third of your credit limit.

If you do any of the above, you should start seeing improvements in your credit record after three months, but it’s recommended to wait about six months before reapplying for a loan.

![How to Make a Budget Plan in 3 Steps [+ personal budget sheet template]](/blog/content/images/size/w600/2024/02/Budgeting-and-counting-out-money.png)