Many people in the investment world often say that it is essential to have a “diversified investment portfolio”. But what exactly does that mean and why is it important? We explain the term, why it’s so important to consider when investing, and how to actually go about diversifying your investment portfolio.

What is portfolio diversification in investment?

Let’s break the term down into the relevant two elements:

1. What is an investment portfolio?

Your investment portfolio is the collection of all your investments. So if you have a fixed deposit, shares, a property, and are putting money into a retirement fund, these are all elements of your investment portfolio. If you don't have any investments – it’s never too late to start!

2. What is a diversified investment portfolio?

Diversification in this context means having different types of funds or components in your investment portfolio. In the investment portfolio example above, we mentioned four different types of investments. Generally speaking, the more different types of investments you have, the more diversified your portfolio is.

All across the world, many people’s largest (and sometimes only) asset is their home which they bought. This is an example of not diversifying adequately – if your property loses value over time, this means the value of your “investment portfolio” could be severely impacted.

Why is investment diversification so important?

Diversification is an important step in reducing your investment risk and so protecting you from making potential losses.

Sure, things may turn out differently and on that day (as sometimes happens when the market has a bad day generally) all your share investments may fall in value (or may all go up!). But the more different types of shares you hold, the less they are likely to move up and down in the same direction.

How do you diversify your investment portfolio?

There are three major ways to diversify your investment portfolio:

- Invest in different company’s shares. Diversifying your investments might mean investing in companies from different industries. For example, you might hold shares in telecoms businesses, banks, luxury goods businesses, oil businesses and retailers. These all operate in different types of industries, and what impacts one might not impact another.

- Invest in different asset classes. The above examples only talk about share investments, but diversification also applies to different investment types, or asset classes. Let’s say you invest in a money market fund and own shares in companies. Both of these types of investments can be impacted by interest rates: higher interest rates will result in a higher return on your money market investment, but it may result in a lower valuation of your share portfolio as more people sell shares to take advantage of the higher money market return. If you are invested in both, then your risk of loss is less as you benefit from the one going up, even if the other goes down.

- Invest in different locations. You could also choose to invest in different jurisdictions or countries to give yourself exposure to different currencies, companies and industries than what is available in your home market.

The more different types of shares you own, the more diversified your share portfolio is. The more different types of assets (by class and jurisdiction) you hold, the more diversified your entire investment portfolio is.

Can you diversify your investment portfolio on the Franc app?

We take investment diversification very seriously at Franc. If you’re a Franc customer, you’ll go through the process of setting your goals and timelines and getting an investment strategy based on different funds available on the app.

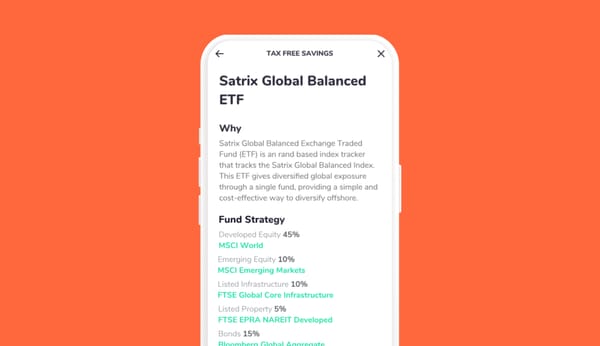

If you invest in the Satrix Top 40 ETF (Franc’s equity fund), you’re investing in 40 of the largest companies on the Johannesburg Stock Exchange (JSE). That means by making one investment, you’re getting exposure to 40 big businesses, like Naspers, Nedbank, MTN, Richemont and Sasol – many of whom operate in very different industries and countries and provide you with a diversified portfolio of share investments.

If you are also invested in the Allan Gray Money Market Fund (Franc’s cash fund), you also benefit from getting exposure to different borrowers, which further diversifies your portfolio.

Is there a catch?

Like with most things, diversification is not a foolproof strategy – it doesn’t reduce all risk. When Covid happened a few years back, the whole market was severely impacted. Having a diversified portfolio may not have prevented losses, but it may have limited your losses.

By investing in many different things, you are reducing risk but also limiting your potential return. Going back to Company A: let's say it went up by 20% and it was the only investment you had. That would be a great result for you. But if it only made up a portion of your portfolio and not all of it, your return would be diluted if everything else didn’t perform as well.

Having a diversified portfolio may mean you sacrifice the best potential outcome (if you somehow made a great investment call), but you also insure yourself against losing a lot of money in the scenario that you made a terrible call!

![How & Why You Should Do a Financial Reset [+ downloadable financial reset journal]](/blog/content/images/size/w600/2024/12/Setting-goals-for-the-year.png)