We all have a relationship with money. It’s influenced by our culture, our community and also our gender. While women are often told they’re not good with money and that they should “leave it to a man”, men and boys are often told that they should be good with money and that it’s their job to provide for and to grow wealth for their families.

As a result nearly three-quarters of all money articles targeted at men are about growing money and investing. In contrast the vast majority of money articles targeted at women are about spending less.

The pressure and expectations of being good with money has some unintended consequences. A new study released by MIT that investigated over 650,000 individual trading accounts found investors who are male, or above the age of 45, or married, or have more dependents, or who self-identify as having excellent investment experience end to “panic sell” with greater frequency during a downturn in the market. Panic sell is the academic term for “freaking out”.

The pressure to be a successful investor leads to behaviour that is contrary to that success, because “freaking out” and selling when the stock market dips is a guaranteed way of locking in investment losses, rather than giving your money time to grow. If you’re not convinced, read our blog article on whether it’s better to cash out or ride it out.

The problem is that with more and more of us working from home and being glued to our laptops, the hype to be a trading pro and reading about success stories of investors who made it big are everywhere - on YouTube, Reddit, Twitter, even TikTok. There’s a pervasive media narrative, focusing mostly on men who are making a fortune in crypto, meme stocks, NFTs, etc. The problem is that successful day trading strategies are short lived and have a lot of investment risk.

Why is this so important?

The pressure for men "to be good with money" and to shoulder the family money responsibilities can do real damage. In fact, the pressure can be enormous and lead to financial stress that can disrupt sleep and lead to severe health issues.

Another surprising outcome of the MIT study was that those who declared themselves to have “no investment experience” are less likely to “freak out” and panic-sell in a downturn. That means that, on the whole, women who historically haven’t traded as much as men tend not to panic sell. This is yet more proof that women tend to be better investors than men.

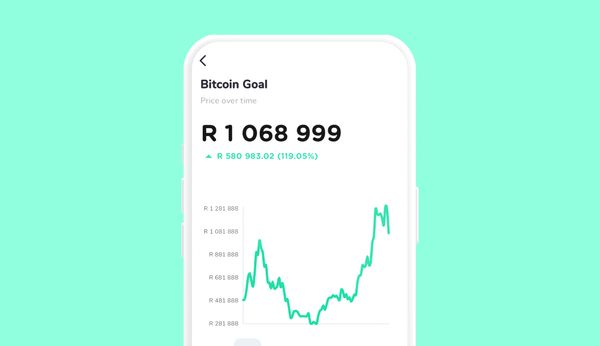

The reality is that market volatility is a given. The performance of your investment is likely to go up and down on a daily basis. The important thing is to put the majority of your investments into a carefully constructed diversified investment portfolio that matches your investor risk profile and household needs. A diversified portfolio is likely to handle market volatility better than individual stocks. That way your conviction stocks will carry less emotional turmoil.

Another thing worth keeping in mind, especially during periods of market volatility, is that historically, investors have been better off investing consistently. So set up your investment goal and stick to your regular contributions.