When I was young, I always looked forward to Christmas. I can’t remember ever really believing in Father Christmas, although I was fooled early on when my sister and I would leave out a glass of milk and some Romany Creams only for them to miraculously disappear by Christmas morning with only a few crumbs as evidence. I suspect my father had to accept this nightcap after we went to bed as the presents were laid under the Christmas tree.

I became a father this year. Our daughter was born in March and it’s been such a beautiful experience thus far. Thankfully we’ve been blessed with a good sleeper and a good eater, the bare necessities for a manageable baptism into parenthood. My wife and I heard horror stories from friends before Elia was born, but thankfully none of them have come to pass.

Obviously, at 9 months Elia is going to be too young to remember this Christmas. Nevertheless, it has given me pause for thought. What do I want for my daughter and what do I imagine her future to be? I have no doubt she will chart her own course. Yet I still feel a sense of responsibility in showering her with love and giving her the tools she needs to navigate the choppy waters of life with grace, as any parent would.

I do not fault my parents for the childhood I had, which was full of freedom and exploration; engendering an appetite for risk and novelty that has served me very well over the years. However, one thing I do hope to change with Elia is equipping her with the knowledge of how to manage money and invest for the future.

My parents did a wonderful job in encouraging me to open a bank account and save my pocket money when I was young. However, it always struck me as odd that I must “put money away” without getting anything in return. In fact, in those days the fees you paid on the account meant that you likely had less buying power than what you originally put in thanks to low bank interest rates and inflation. That struck my precocious mind as unfair. And so, unsurprisingly, I tended to live in the present and enjoy the spoils of my pocket money at the local cafe buying sweets for me and my friends.

I think the most important lesson to impart to your children is not the benefits of saving (i.e. not spending your pocket money until some future point in time) but instead, the benefits of investing. Because if I had experienced the power of capital or compound growth as a child, my financial future would have looked a lot different.

I’m pretty sure I wouldn’t have understood the underlying mechanics but I would have appreciated the fact that today I could have bought 5 sweets, but if I invested my pocket money there was a chance that I could buy 10 sweets in the future. Now that was mathematics I could appreciate. As opposed to, buying 5 sweets now or maybe 4 sweets in the future.

This simple fact has inspired me and the Franc team to implement two important features before Christmas: child accounts and linked accounts. Each of them has the potential to radically change the future of the beneficiary.

Child accounts allow any Franc investor to create an account for their children or their dependants seamlessly through the mobile app. All they have to do is sign up on behalf of their child, consent to their child investing with Franc and upload a birth certificate (or equivalent). Parents and guardians can even deposit into their kids’ accounts from their own profile through the app and share a deposit link with grandparents and extended family members so that they can contribute to the investment portfolio of the child easily through the Franc website.

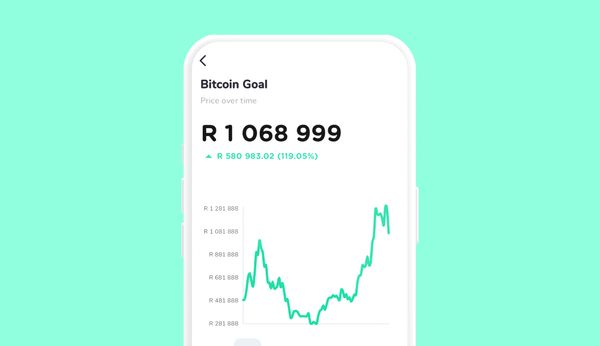

By doing so, parents can give their children the best gift ever - an appreciation for how money can grow over time. Not only that, you also give your child the longest possible time for their money to grow, giving compound interest the best chance of working its magic!

Importantly, the Child Account is in the name of the child so as they grow up they can take control of their own investment portfolio, which hopefully inspires them to invest further and aspire to financial freedom.

Our Linked Accounts are similar, in that it allows Franc users to set up an investment account for someone they know who might need a bit of help in getting started.

The rationale for Linked Accounts is that the Financial Sector Control Authority (FSCA) asked the Human Sciences Research Council (HSRC) to do multiple financial literacy surveys over the past decade (key findings are available at https://www.fscamymoney.co.za). The latest survey found that only 16% understood the concept of inflation, 46% could answer a basic interest question, and 35% could answer a compound interest question. Momentum and Unisa Science of Success Insights report 2022 found that the youth scored an average financial literacy of 36 out of 100 - not a good sign.

As a co-founder of Franc and as a father, I encourage all parents and guardians to create an investment account for children, so that you can teach them the most valuable lesson in life - money that is invested can grow. And as someone who invests, I want to encourage all Franc investors to consider setting up an investment account for a family member, friend, or employee who you think might appreciate or need the help.