When the stock market is in turmoil (as it currently is due to COVID-19 and the oil price wars), many investors are tempted sell out their equity investments and transfer their money into cash until the markets start to recover, and then buy back in.

Although on the surface this may seem like a sensible approach, the trick here is how to time your exit and entry — because unlike a thunder storm there isn't a clap of thunder announcing its arrival, giving you time to run for cover, or a ray of sunlight announcing it's over. Investors will not receive a WhatsApp message from the stock market saying that the markets has hit rock bottom and that it's time to buy back in.

The huge fall in the markets over the last six weeks has left the JSE All Share Index down around 35% at its lowest. Based on previous crashes, that means that could have been the bottom. Selling at the bottom is never a good idea because then you are realising your losses.

The market might recover a bit (as it already has) and then fall again – double-dips are quite common in these situations. Should you try and sell if there is a partial recovery? Selling out to cash has a very real but less visible danger: missing out on the recovery. To buy back in at exactly the time is not easy, which is why we recommend riding out the storm.

The point is best illustrated with examples. Let's look at three investors who started to invest in 2005. For simplicity, this example doesn’t include the impact of taxes or inflation, and assumes that dividends and any capital gains are reinvested.

Sizwe

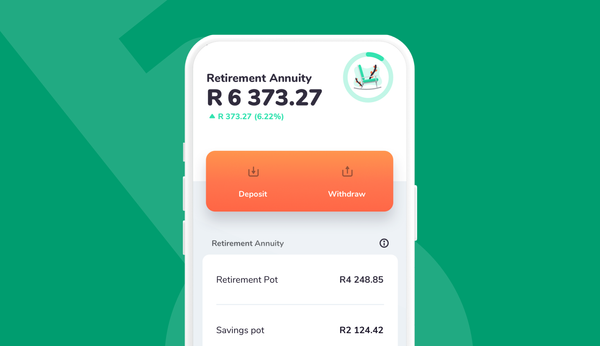

Sizwe invested R12,000 in March 2005 with 90% allocated to equity (Satrix Top 40 ETF) and 10% cash (Allan Gray Money Market). He then invested R1,000 per month for the next 15 years until the end of February 2020. Over this 15 year period, Sizwe's total cash investment was R191,000. At the end of February this year his portfolio had grown to over R400,000 (R404,573 to be exact).

Despite having gone through the financial crisis, Sizwe's portfolio more than doubled.

Lindi

Now let’s look at another investor, Lindi, who invested exactly the same amount with the identical fund mix as Sizwe, but decided to sell the equity portion of her portfolio and transfer it to the money market account at the end of 2008. Was she better off?

When Lindi cashed out her equities at the end of December 2008 – the market had rebounded from its mid-November low – her Satrix 40 shares were worth about R60,000 having invested R50,400 to date (a c.20% gain after less than three years).

In August 2009 (with the market recovery six months old) Lindi felt comfortable getting back in to shares. She took her proceeds from the 2008 sale (leaving R20,000 in her money market account) and reinvested with the same 90/10 investment mix as before. She continued her monthly investment of R1,000. (In the meantime she had continued investing R1,000 a month into the money market account).

By the end of February 2020, Lindi’s portfolio was worth roughly R378,000, which means Sizwe's portfolio was ahead by nearly R26,000.

Mo

In the last scenario, let’s look at Mo, who’s strategy was just like Lindi's, but Mo waited longer – until January 2011 – to get back into equities with the same investment and contribution strategy as before. At the end of February 2020, Mo's account was worth R348,000 – over R56,000 less than Sizwe's account and more than R30,000 less than Lindi’s.

The cost of missing the run

The under-performance of Lindi and Mo compared to Sizwe is the cost of missing the first part of the next bull market.

By selling to avoid further losses, Lindi ended up missing out on the first six months of the next up-market – it cost her R26,000. Mo missed out on the first third of the next bull market and waved goodbye to R56,000 he could have had.

Almost the only way to not miss out on part of the next run is to stay invested.

Looking at charts of previous crashes, it's easy to imagine you would have got out at a good level and got back in right at the bottom. In reality, almost nobody gets this right, not even the professionals.

Do you know where the stock market will be in three months? Will it be lower or higher than today? Nobody knows for sure – and that's way it is so hard to get back in at the right time.

Set yourself a goal and stick to it

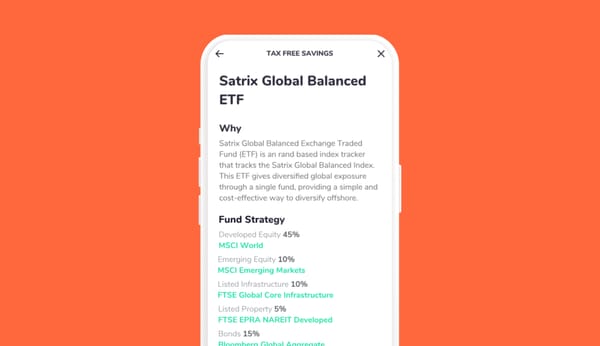

Given that the market is going to go up and down, the best approach to take is to set yourself a goal and stick to it. With careful planning and portfolio construction you can take a backseat and ride out the ups and downs because portfolios that are thoughtfully constructed and diversified are built to withstand market volatility over the long term.

That is not to say things can’t go wrong or that the outcome is guaranteed —because it's not, but at least that way you can avoid making the mistake Lindi and Mo made. Investors have much better odds of success when they rely on tested investment principles. And sometimes it helps just not to look!

![How & Why You Should Do a Financial Reset [+ downloadable financial reset journal]](/blog/content/images/size/w600/2024/12/Setting-goals-for-the-year.png)