We all know that savings is income less expenses: how much you earn, minus how much you spend. And although we all wish we could earn more, the reality is that unless you’re willing to take on another job or upskill yourself and find a job that pays more, the chances are your income is unlikely to increase dramatically. That means the only thing you have total control over is how much you spend on a monthly basis.

Let’s compare your spending to… the energy efficiency of car engines?

We’ve all heard by now that burning fossil fuels, like oil, results in greenhouse gas emissions that impact climate change by raising the average surface temperature.

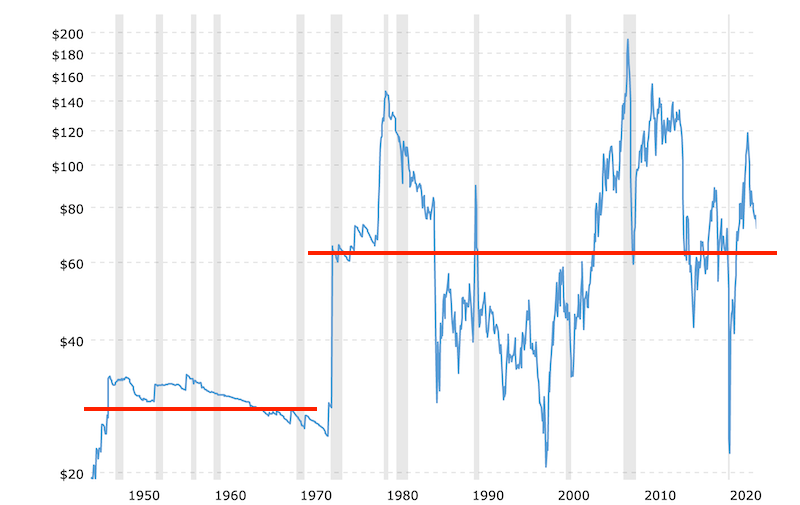

More than 40 years ago, however, the only worry was the rising cost of crude oil due to increased demand (more people and more cars) and reduced supply (fossil fuel reserves are fundamentally finite, and will eventually run out); classic supply and demand theory. But as you can see in the chart below, the average price of oil (inflation adjusted) has largely remained constant over the past four decades.

How has the price of oil remained (largely) the same, even while demand has soared?

The answer is improved energy efficiency. Given that we didn't (and couldn’t really) massively increase the amount of oil we were extracting and processing (global crude oil production increased about 16% over the past 40 years), the only thing we could change was how efficiently we were using the fuel we were producing. Over the past 40 years the average fuel efficiency of cars has gone from 6 km per litre to 10 km per litre, a 66% increase. To put it in other words, our improvement in energy efficiency has been four times better than our increases in production.

What does this have to do with me and my savings?

I hope this example showed that you should be focusing on changing what you can control: how much you spend. Reducing how much you spend on a monthly basis – in other words, being more efficient with your spending and making your money stretch further – can dramatically increase your savings, far more so than waiting for your income to increase.

Let’s be honest with ourselves for a minute: how much we spend is really a reflection of ego. We think of ourselves as being able to afford certain things in life. The greatest trick our minds play on us is convincing ourselves that most of our expenses are necessities, when in reality this is far from the truth. Many expenses are ‘wants’.

Let's start spending more efficiently

Now that you understand that efficient savings is key to financial success, the next step is to take action. Here are a few ideas to get started:

- Document your expenses for the last month to see where your money is going.

- Once you have a clear understanding of where you're spending your money, categorise your expenses. These categories could be eating out, groceries, or clothes.

- Interrogate your spending categories: is there a category you're spending on that isn't actually that important to you? Could you replace it with something that you enjoy more, or get rid of it completely?

- For those categories that are necessities, like groceries or travelling to work, look at ways to spend more efficiently in that area. Consider buying ingredients in bulk, or taking the bus to work.

- Create a stop order for your savings to make sure you pay yourself first without even thinking about it. You can do this in the Franc app through our recurring deposit feature or directly via your banking app, and make it fun by joining a Savings Challenge. You'll be less likely to spend that money.

In life there are three types of people: those who save, those who think they can’t afford to save and those that think they don’t need to. Saving is really a mindset. It is the gap between your income and your ego. If you can tame your ego, you’ll want less and care less about what others think of you, which will likely decrease how much you spend. That's what spending efficiently is all about, and it's a surefire way to increase your savings.