Hello, 2023! It’s a new year, a clean slate, and the end of the first quarter – which means our first market update for the year.

Why should you care about the market update?

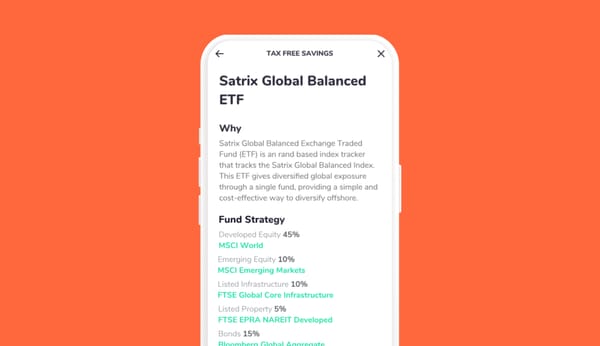

As a Franc user, you have access to the Satrix Top 40 ETF, which is an equity fund made up of the largest 40 companies listed on the Johannesburg Stock Exchange (JSE). Investing in the fund through Franc saves you the time and worry of investing in individual shares, while still giving you the benefits and growth of the stock market. If you’ve invested in the equity fund provided by Franc, this update gives you some insight into your investment performance.

So how did the Satrix Top 40 ETF do?

The first quarter of 2023 was mostly good for the top 40 companies on the JSE: 21 of the top 40 companies saw gains (growth). This was due to promising financial results and positive outlooks for the rest of the 2023 year. However, increased inflation and interest rates, turmoil in the global banking sector and load shedding all dampened what could’ve been an even more impressive start to the year.

At the end of the first quarter of 2023 (January-March), the Satrix 40 ETF closed at R71.15. That's a 5.75% increase on the previous quarter (R67.28).

Let’s look at the performance of some of these individual companies’ shares within the fund to understand the overall increase:

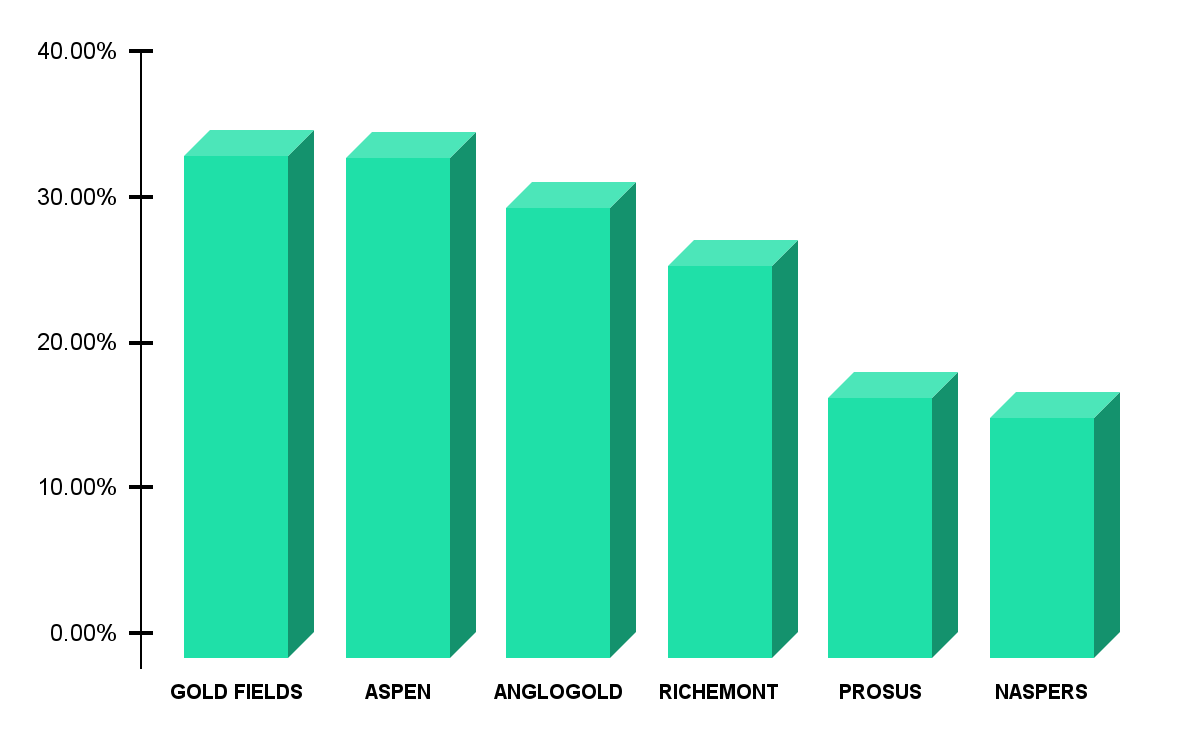

Top Performers

Gold Fields and AngloGold Ashanti were 2 of the top 3 performing companies this quarter. Gold Fields' share price increased from R176.15 to R237 (+35%), while AngloGold’s share price increased from R329.23 to R431.40 (+31%).

It’s no coincidence that they’re both gold mining companies. Gold prices have seen near all-time highs, close to $2000 per troy ounce (in South African terms: R36,500 per 31.1g). This is an increase of 10%, just this quarter.

What’s behind gold’s strong performance?

Prices are driven by basic supply-and-demand dynamics. According to the World Gold Council, global gold demand increased 22% in 2022. A declining US dollar, fears around an economic recession and high inflation also drove up the price. These high gold prices, together with the news of Gold Fields and AngloGold Ashanti forming a joint venture to create one of Africa’s largest gold mines, were the catalysts for the companies’ great performances this quarter.

Other big winners

Another real winner this past quarter was Aspen. Aspen’s share price increased from R136.33 to R183.18 (+34%) in the past 3 months. This was due to the news that Aspen concluded an agreement to use pyrolysis (conversion of plastic waste to energy) at its Gqeberha manufacturing facility, enabling its manufacturing facility to be off the grid within the next two years. This is Aspen’s literal light at the end of the long dark tunnel also known as loadshedding. (Cue notification: “loadshedding starting in your area in 55 minutes”).

Other big winners this quarter were Naspers and Prosus. Naspers’ share price increased from R2824.34 to R3292.96 (+17%) and Prosus’ share price increased from R1177.76 to R1388.94 (+18%). This increase was due to Chinese tech stocks continuously increasing in price (referred to as a ‘rally’). Sentiment in the Chinese market was boosted by unexpectedly strong manufacturing data that suggested economic recovery is gathering pace. Prosus, Naspers’ subsidiary, holds close to 30% of Tencent, a world leading Chinese internet and technology company.

Also in the green this quarter was Richemont, the luxury goods manufacturer. Record highs were experienced this quarter as their share price was up to R283.45 from R223.15 (+27%) at the end of last year. This was due to impressive financial results and record sales in the new year.

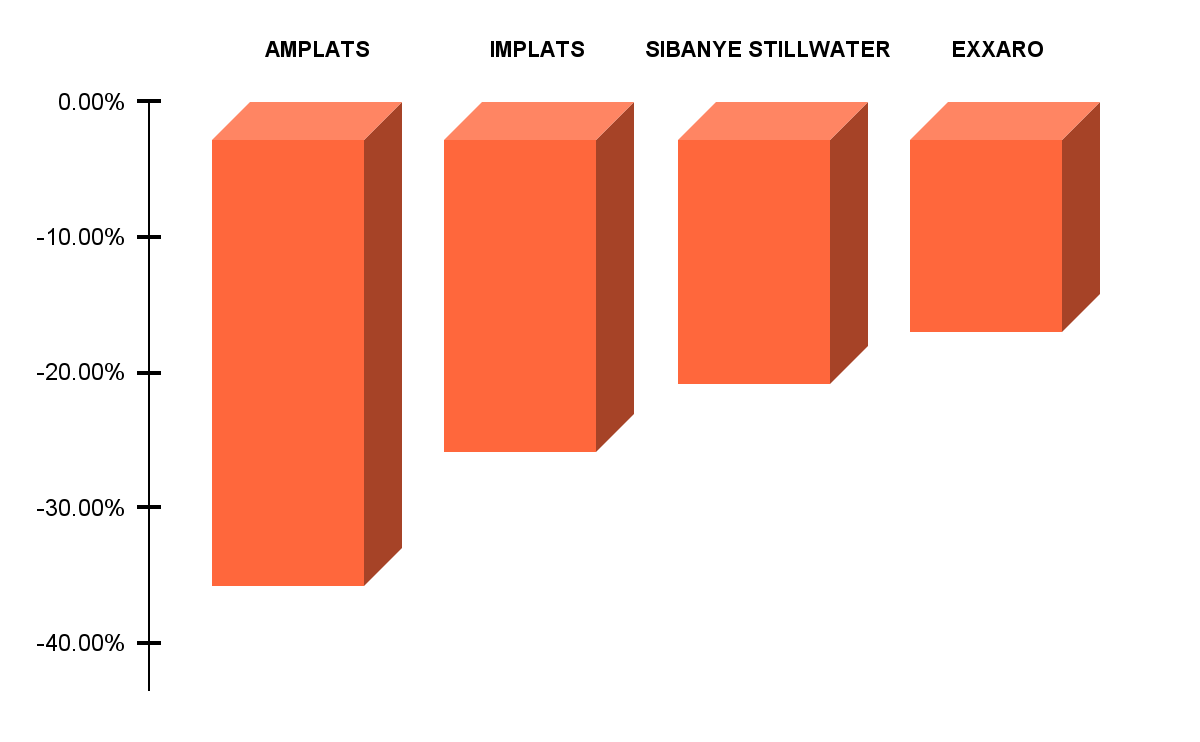

Worst Performers

The biggest losers this quarter were Anglo American Platinum (Amplats) and Impala Platinum (Implats). Amplats closed last year at R1424.88 per share, but this decreased to R954 (-33%) by the end of this quarter. Implats share price decreased from R213.14 to R163.8 (-23%) by the end of the first quarter.

Amplats’ poor performance is connected to its poor financial results. It reported a 38% decrease in annual earnings, and a 25% decrease in production, partly due to loadshedding, an increase in production costs due to inflation and a dividend declaration of less than half of the previous year.

Similarly, Implats reported a 2% decrease in half year profit and a 20% decrease in their interim dividend declaration. Their continued lower production levels due to power cuts didn’t help, as Implats questions the ability of miners to go underground if the power situation worsens. The longer loadshedding continues, the darker the times for SA’s top platinum producers.

Sibanye-Stillwater also had a lacklustre start to the year, as their share price decreased from R44.72 to R36.63 (-18%) this quarter. This is due to poor financial results (profits plummeted 44% last year) and reduced production output as a result of a 3-month strike at its SA gold mines, and a flood in one of its US mines. Eish.

Exxaro, one of the top 5 coal producers in the country, was also in the red as its share price decreased from R217.31 to R186.55 (-14%). Despite having fairly strong financial results in 2022, Exxaro declared a lower dividend to its shareholders and is continually being crippled with logistics issues. Exxaro is now trucking some of its coal to ports due to the shortage of locomotives, cable theft and vandalism of Transnet’s rail infrastructure.

2023: onwards and upwards!

This quarter’s mixed performance is a reminder that investing in the equity market is a long-term practice. Even though share prices can experience some dark times, they also have plenty of bright times. The longer you keep your investment, the more of those bright times your investment benefits from.

![How & Why You Should Do a Financial Reset [+ downloadable financial reset journal]](/blog/content/images/size/w600/2024/12/Setting-goals-for-the-year.png)