The phrase "don't put all your eggs in one basket" is a commonly used one. It means that we shouldn't rely only on a specific event working in our favour, we should spread our risk. Literally if we drop the basket, all our eggs will break and we would have nothing left. But if we had eggs in more than one basket, we could still make an omelette or whip up that lockdown banana bread!

This is a key concept in investing as well. Generally speaking, the more different types of investments you have, the more diversified your investment portfolio - in other words, you have spread your investment risk without sacrificing your potential investment return. This can be shown in the following example:

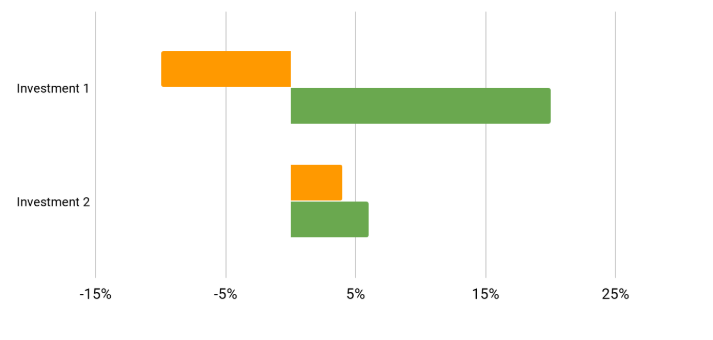

Which investment would you choose? The one which is equally likely to give you a -10% return or a 20% return at the end of the year? Or the one which is equally likely to give you a 4% or 6% return? Both investments have an expected return of 5% but as you can see, the one is much riskier than the other. This is the benefit of diversification - you can get the same expected return but with much less risk. As you can see there is a downside to diversification - you give up the potential to earn 20% but you also reduce the probability of losing money.

Win some, lose some

Practically how does this work? Well if you had only shares of one company in your portfolio - let's say ABC Ltd, the value of your portfolio would move up or down with the share price of ABC Ltd. A company's share price can move up a few percent one day and down a few percent the next, depending on both general market conditions and that company's prospects. If you own shares of two companies (ABC Ltd and XYZ Ltd), the value of your portfolio would move in line with the share prices of both companies. One may increase in price whilst the other may decrease on the same day or vice versa. Or both may increase or decrease. Now the value of your portfolio depends on general market conditions and the prospects of 2 companies, not 1. You have spread your risk.

When you invest in an index tracker fund (such as the Satrix 40 ETF) you are investing in 40 different companies at once. So you are making one investment but at the same time are spreading your risk amongst the largest companies in South Africa such as Naspers, Anglo American and Standard Bank. If you invest R100 in this fund, approximately R24 of this goes into Naspers shares, R7 into Anglo American shares and R2 into Standard Bank shares (the larger the company, the more of your money is invested in it). What's also good about this type of investment is that although these companies are listed on the JSE, many of them are global businesses that make a lot of their money outside South Africa and as an investor you benefit from this as well. The prices of some of these shares may go up whilst some may go down - the price of the Satrix 40 ETF takes all this into account, giving you the benefit of diversification without you having to choose which shares to buy yourself. Diversification doesn't only work with shares. If you choose to also invest in a money market fund, bonds, property etc these further diversify your portfolio.

You diversify your investments knowing that it will never be the best investment you could have made but it will also not be the worst - anyway unless you have a time machine there is no way to know now what the best investment will be. That said, having a diversified portfolio in itself may not be enough, you still need to stay true to your investment strategy and have a long term mentality even when it isn't easy to do.

![How & Why You Should Do a Financial Reset [+ downloadable financial reset journal]](/blog/content/images/size/w600/2024/12/Setting-goals-for-the-year.png)