Let's face it, learning about money can sometimes be a snooze-fest. In this blog post, we're diving into five fantastic financial literacy books written by African authors that will not only inform you but also put you on track for a much more fun journey to financial freedom. Get ready to unlock the secrets of managing money, building wealth, and achieving financial independence, all from an African perspective. Whether you're a seasoned investor or just starting your financial journey, these books offer an invaluable blend of knowledge and practical guidance.

1. "The Smart Money Woman" by Arese Ugwu

This book offers practical financial advice through an engaging narrative. Through the story of Zuri, a hard working career woman, readers are taken on a journey that explores various aspects of personal finance with relatable examples and insightful excerpts. One of the key lessons in the book is the importance of budgeting. Ugwu illustrates this by showing how Zuri's lack of a budget leads to financial stress. Zuri's friend, Tami, tries to help her understand the significance of budgeting, “Zuri, budgeting is like having a financial GPS. It helps you map out your income, expenses, and financial goals. It gives you control over your money and helps you make intentional choices about how you spend and save”.

Arese Ugwu offers practical advice on budgeting, debt management, saving, and investing. Whether you're a financial novice or seeking to enhance your money management skills, this book is an invaluable resource that will leave you feeling inspired and equipped to make smarter financial decisions.

2. “You’re not broke, you’re pre-rich” by Mapalo Maku

This book is like having a serious conversation with your financially savvy best friend who knows how to sprinkle some laughter into the mix. The author shares her own money mishaps and triumphs, making you feel like you're not alone in your financial struggles. Her relatable stories will have you nodding your head and laughing out loud, realizing that we've all made some questionable money decisions at some point in our lives.

What sets the book apart is Maku's emphasis on mindset and attitude towards money. She encourages readers to shift their perspective from scarcity to abundance, and from a victim mentality to one of empowerment. By doing so, she believes that anyone can overcome financial challenges and achieve long-term financial security.

3. “Stokvels” by Palesa Lengolo

If you are a reader who is already in a stokvel, or who wants to be in one, and even if you have never thought of joining one, this is a must-read for you. Stokvels addresses the problem of lack of financial literacy in Africa by clearly explaining financial principles and how to make sound financial decisions. The author goes on to write about many challenges and pitfalls stokvels have recently faced and how to navigate their architecture. If you are a part of the Franc stokvel, or have been looking to be part of it, this could be the perfect place to start and learn about some stokvel dynamics.

4. “The African Millionaire Next Door” by Tosan Omatsola

For the best motivation this Africa month, Nigerian author Tosan Omatsola challenges common misconceptions about wealth and success in Africa in his book. He writes it with extensive research and interviews with successful African entrepreneurs and professionals to uncover the hidden habits and principles that have led to these Africans’ financial prosperity. The book offers valuable lessons on entrepreneurship, investing, and creating generational wealth within the African context.

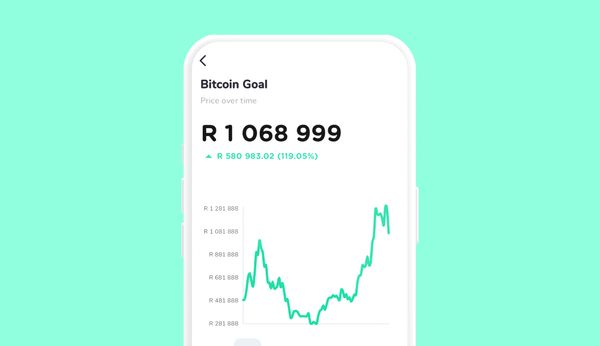

The African millionaires featured in the book prove that success knows no geographical boundaries. They demonstrate the power of persistence in the face of adversity and the significance of continuously seeking knowledge in the realm of personal finance. They also exemplify the importance of giving back to their communities, leaving a lasting legacy that uplifts others. If this inspirational book doesn’t get you started to work towards your biggest financial goals, then I don’t know what can. This is the perfect time to break your financial independence boundaries, set up your wealth goal on the Franc app and make it a habit to invest towards your millionaire aspirations.

5. “From Debt to Riches” by Phumelele Ndumo

Ordinary South Africans are constantly battling with financial problems such as garnishee orders, admin orders, debt counseling, paying university fees or buying homes. In this easy-to-read guide, Ndumo talks about financial issues in such a simple manner that you can read it while you are under the hair dryer in a hair salon.

If you’re trying to get out of and avoid debt, this book is the best thing you can do for yourself as a starting point. It is for parents who have dreams of investing in their children’s university studies but are battling with finances for that. It is also for the young people who are still starting out with their own finances. You might also want to buy it as a gift for that clueless sibling who always asks you for a loan - it’s a sure fire way for them to learn about better money management.

Get That Book!

Financial literacy is a crucial skill for everyone, regardless of their background or location. These books by African authors provide valuable insights, strategies and practical guidance from the perspectives of our communities to help readers navigate their financial journeys successfully. All we’re saying is, if you need a starting point from the backyard, this is it!