The equity fund you can invest in through Franc is the Satrix 40 ETF, an index tracker fund that effectively allows you to invest in the largest 40 companies on the JSE at once. The price of the Satrix 40 ETF was R60.66 as at 30 June 2021 and R59.34 as at 30 September 2021, a fall of just over 2%. This is a reasonably small change for a quarter but let's look at what caused the drop.

Q3 similar to Q2

The Top 40 was up 7.6% in Q4 '20 and up 12.9% in Q1 '21 so has been on a good recent run. However, Q3 '21 was similar to Q2 '21 with regards to the small drop. Also there were quite a few similarities in terms of which companies did well and which didn't.

So who performed and who didn't?

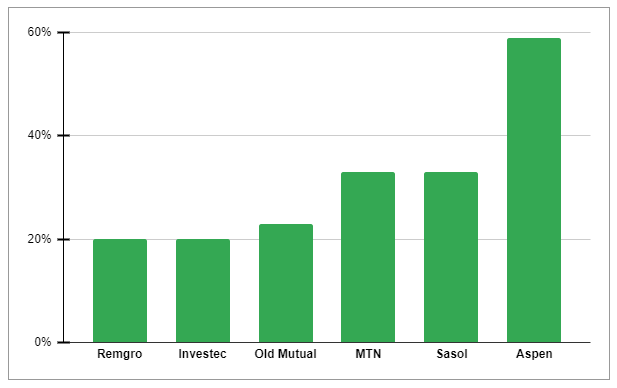

Winners

Aspen was the quarter's largest upward mover by a long way with the price increasing by 59%. This momentum started last quarter as we learnt that the company had started to produce Johnson and Johnson Covid-19 vaccines locally. In the recent results announcement Aspen informed the market that earnings were up 21%, debt was more than halved and the company paid its first dividend for more than 2 years - all music to shareholders ears.

MTN performed very strongly for the 3rd quarter in a row trading at around R137 at the end of September 2021. Around 12 months ago the share was trading around the R50 mark! MTN also recently overtook Vodacom in market capitalisation to be the largest African telco. Again, the market is bullish about the company's asset disposal strategy as well as local and African units performing well.

Sasol is another company that has recovered very well since the lows of 18 months ago. Sasol ended the quarter at around R290 - amazing to think it was trading in the R20's not so long ago! The recent surge in the oil price together with operational improvements and the headache of the Lake Charles project mostly behind it has resulted in the share price performing so well.

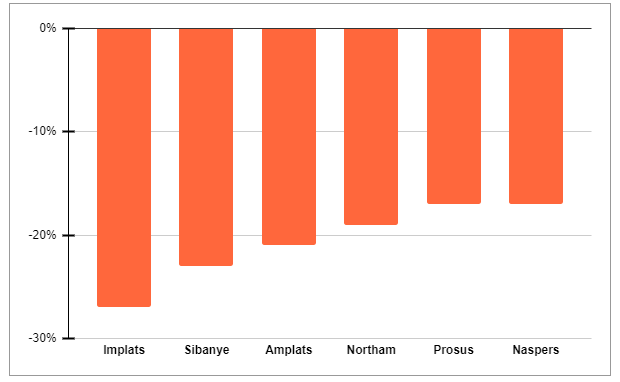

Losers

Platinum mining businesses have performed very well in the recent past but took big knocks in both Q2 and Q3. Northam, Amplats, Sibanye and Implats all fell by between 19% and 27% over the quarter. The share prices of these businesses are heavily geared to the price of Platinum Group Metals. Over the past 3 months the rhodium and palladium price fell by more than 30% with the platinum price falling by more than 10% given the reduction in Chinese demand for the metals.

Naspers and Prosus were also big losers with both prices falling around 17%. The main reason for this was the clampdown by Chinese regulators regarding online content regulations. This move in itself hurt the companies but it also spooked investors into considering what other tricks the Chinese government had up their sleeve that could impact other parts of the businesses.

It was disappointing to see the market fall again slightly in Q3 however when investing in shares it is best to have a long term mindset. History has shown that if you are patient and remain in the stock market for an extended period of time, you are more than likely to make a good return on your investment. You can also now view the Satrix 40 ETF historical performance in the app so you don't need to wait for this post every quarter if you want to see what's happening in the market!