As a Franc customer, you have 2 funds to choose from. Our cash fund is best for short term goals (where you earn a steady return with very little chance of capital loss) and we suggest equity exposure (shares in companies) for longer term investments. The equity fund we have chosen for you is the Satrix 40 ETF, an index tracker fund that effectively allows you to invest in the largest 40 companies on the JSE at once. The price of the Satrix 40 ETF was R61.62 as at 31 March 2021 and R60.66 as at 30 June 2021, a fall of 2%. This is a reasonably small change but let's look at if there were any big movers in the underlying companies.

What goes up...

Equity markets can be volatile and go through periods of upswings and downswings. The Top 40 was up 7.6% in Q4 '20 and up 12.9% in Q1 '21 so has been on a good recent run. However, the stock market can't always perform well so this quarter's drop was not unexpected. Long term investors have to be patient with their investments and remain invested even when the market does not perform so that they take advantage when it does.

So what happened then?

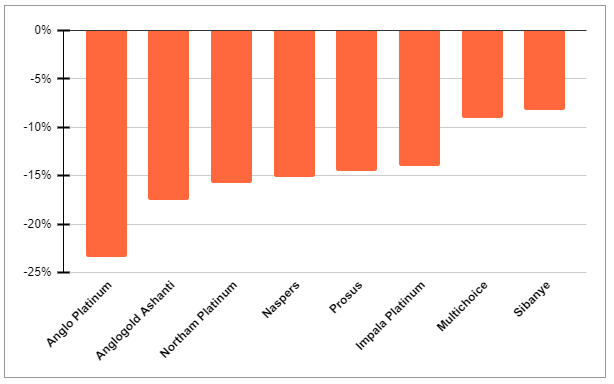

Naspers comprised around 20% of the Satrix 40 ETF and was down by 15% for the quarter so made a sizeable contribution to the ETF's negative performance. This large fall also meant that Naspers' weighting in the Top 40 fell from over 20% to under 18% at the end of June. Have a look at this article for an explanation as to how ETFs and weightings work.

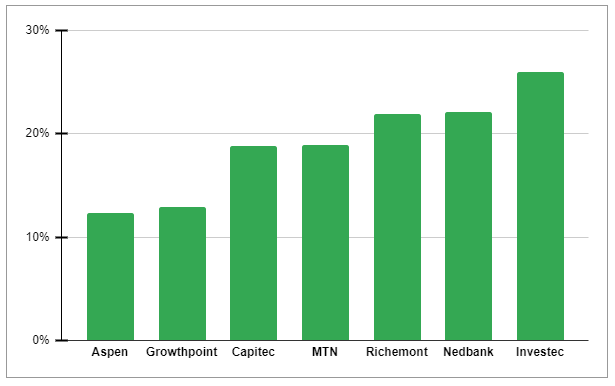

Winners

Nedbank, Capitec and Investec were some of the biggest winners of the quarter - these banks benefitted from the rand strength as well as a likelihood of dividend recovery by the end of the year. Richemont (which owns brands like Cartier and Montblanc) posted good results on the back of luxury goods sales improving as many countries move out of lockdown and travel restrictions soften.

The market is still bullish on MTN's asset disposal strategy as discussed last quarter (selling some assets to generate cash and redirect focus to their core business). The property sector showed a recovery in Q2 and Growthpoint is the largest local listed property business so followed that trend. Aspen benefitted as they have started to produce Johnson and Johnson vaccines locally.

Losers

Platinum mining businesses have performed very well over the past few quarters but took big knocks in Q2. Much of the previous positive sentiment was driven by the Rhodium price but this was down by more than 20% over the quarter leading to large falls in the share prices of Anglo Platinum, Northam Platinum, Impala Platinum and Sibanye. The Platinum price also fell by around 10% over the quarter.

Naspers/Prosus announced more corporate restructuring which the market is not convinced of and this together with increased Chinese regulatory pressure has resulted in material drops in these prices. Multichoice has come off after its results were released, potentially because of the market not liking its deal to acquire a material stake in a betting company as it looks to diversify away from Pay TV.

Investing in a product like the Satrix 40 ETF allows you to diversify your investment - you invest in a number of companies at once. So even when the largest company in the index drops by 15%, the whole fund only went down by 2% because there were other companies that performed well. This may limit your return but also ensures your chances of big drops are substantially reduced.