Investing and trading are often confused, just like investing and saving sometimes are. We unpack the differences between them, and highlight the advantages and disadvantages of both.

What is the difference between trading and investing?

Investing and trading are both a means to try to generate a positive return (make a profit). You would also normally invest or trade in financial assets like shares. The biggest difference between trading and investing is how long you intend to hold the asset for.

Let’s dive into both to better understand what we mean by that.

What is Trading?

Trading is the buying and selling of securities or instruments – such as shares, bonds and currencies – within a very short timeline. Most often, a trader will buy something they think will go up in price very soon so that they can sell at a profit. Other strategies include short selling an asset in the belief it will go down quickly. Essentially, traders attempt to take advantage of assets that are temporarily mispriced.

Although skilled traders can earn a good profit relatively quickly, there are also 3 big disadvantages to trading:

1.Trading can be very risky business. Unless you are quite a skilled trader, you could make losses very quickly. As a trader, you need to pay constant attention to what is happening in the market.

2. You need a decent amount of capital to make big profits. In order to make proper money trading, you either need to be trading high Rand amounts, or use leveraged instruments in order to inflate your return.

3. There can be high fees on buying and selling. Depending on the platform you are using to trade, you could be paying fees on every buy and sell, which eats into your potential profits. You could also pay a much higher tax rate on trading profits as they can be taxed at the same rate as your salary.

What is Investing?

Investing is also the buying of securities – such as shares, property or other items of value – that are likely to grow in value over time to provide returns in the form of interest or or capital gains.

Unlike trading, it’s a much more long-term activity and the strategy is to buy-and-hold: some say for at least 3 years, but for someone just starting work and investing for retirement, they will likely be holding on to their investments for around 40 years!

Here are 3 things to consider when you want to start investing:

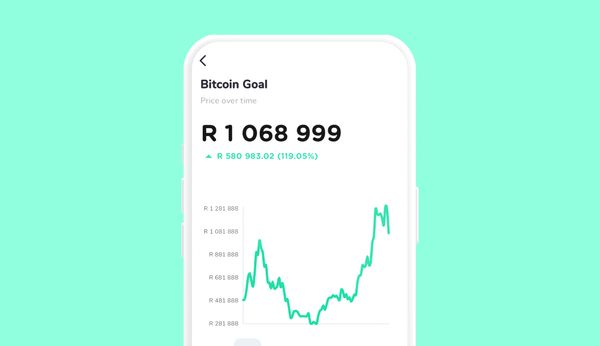

1.Investing is for the long term. When you invest, you’re usually putting away money for the future that you have no immediate need for. That means that if the value of your investment drops drastically, which can happen with higher-risk investments, you can “hold” the asset (keep it without selling) and ride out the fluctuations until there’s an upturn, with the knowledge that you have the luxury of time and don't need to lock in your loss.

2. There’s a broad spectrum of assets you can invest in. Investing also opens up access to some other assets, such as property, which you can't really trade given the lack of liquidity and high fees that come with buying and selling property.

3. You can – and should – “invest and forget” if you are invested in quality assets. There’s no need to keep paying attention to your portfolio and what's going on in the markets – if you’ve invested in good assets. Even if you have a long-term mindset, you can still invest in bad assets, so although time is on your side as an investor, you need to invest in the right assets.

Trading vs. Investing FAQs

How much do you need to start trading?

In theory you can start with any amount, however it's unlikely you will be able to make much money starting with a small amount. The other thing to consider is whether the platform you are using has minimum trade amounts – you would then need to have that amount of capital to start as a bare minimum.

Is trading gambling?

If it's an inexperienced, underqualified person who is the one doing the trading, then yes: it is very close to gambling as you are speculating on something you have very little knowledge about. That’s because trading often has a binary outcome (win/loss). If it is a professional doing the trading, then it is less risky.

Does trading mean investing?

Trading is when you buy or sell an asset and hope to make a return in a short period of time. Investing is generally when you buy an asset and hold it for a longer period of time in the belief it will appreciate in value.

Can an investor be a trader?

Well, when an investor buys an asset they are technically trading in order to buy the asset. However their long term hold of the asset means they are an investor not a trader. So an investor will trade but a trader won’t really be an investor.