One of Franc's unique selling points (which our customers love) is that we try to keep things as simple as possible. It is for this reason that we currently only offer three funds on the platform: the Allan Gray Money Market Fund (the cash fund), the Satrix Top 40 ETF (the local equity fund) and the Sygnia Itrix S&P 500 ETF (the offshore equity fund).

The cash fund earns you income, whereas the equity funds increase your wealth through capital growth (and possibly income, too). So what's the difference?

Explaining capital growth and income

In investment terms, 'capital' means an amount of money that you have available to invest.

There are two ways your capital can grow:

- Your capital can earn an income. A good example here is the interest you earn in a savings account in a bank – the bank is paying you to borrow that money, and that’s income. You also earn an income if you buy a house and rent it out to tenants, who pay you rent. That income is sometimes called passive income because you don't have to work for it – your capital still earns interest when you're asleep, or if you quit your job.

- Your capital can increase in value. This is called 'capital growth' and happens when you put your capital into something that changes in price – like a house, company shares or Krugerrands.

Some investments give you both capital growth and income. A house could increase in price while you own it, and earn income if you rent it out to a tenant. Like houses, the shares of companies listed on the stock exchange usually (over time) go up in price, and some companies also pay income to shareholders in the form of dividends.

Other investments offer only one or the other. For example, a savings account only pays interest (or income); there’s no chance for you to earn capital growth on it. Gold coins like Krugerrands, on the other hand, will only give you a return on investment (i.e. capital growth), if the price of gold rises – you don’t earn interest or other income from gold coins.

Differences between investment returns on the money market vs. equity funds

What do you earn in a money market fund?

When you invest in a money market fund, you are lending out money to government and large institutions who then pay you interest on the money you are lending them. With money market funds, the unit price remains the same and the only form of return is the interest or income earned.

The likelihood that they will not be able to repay you is very small, so the chances of you losing any money is extremely low – your initial investment or capital is in extremely safe hands.

What do you earn when investing in shares and equity?

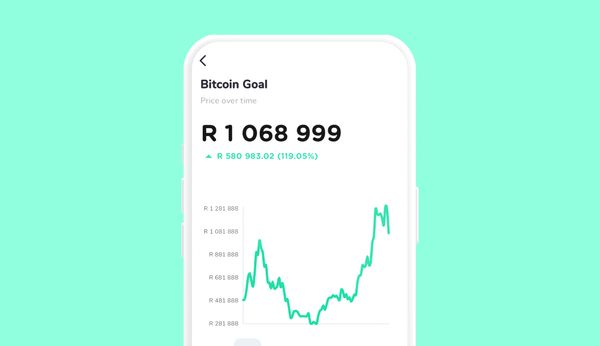

When investing in the stock market in equity ETFs or shares, you are investing in businesses and are hoping that they perform well and that their share prices go up so that you earn capital growth.

The share prices of companies can go up or down in the short term and can be quite volatile – their prices depend on supply and demand. Higher demand for a share pushes the price up, whilst if there are lots of people selling (more supply), this will push the price down.

Supply and demand will depend on general market dynamics (for example, the Russia-Ukraine war made investors jittery and cautious and generally cut demand and increased supply), whereas if a specific company posts very good results that the market was not expecting, this should have a positive impact on the company's share price, even if the rest of the market is suffering.

Companies also pay dividends when they have excess cash – this goes to shareholders and is effectively income earned on the shares.

As you can see, the money market fund does not provide any capital growth opportunity – the only return is the interest (income) paid out every month. This is why these investments are best for short-term horizons as your capital is secure and you earn a return better than most banks.

However, the share/equity ETF investment can go up or down in value (history has shown us that if you are invested for a long period of time, your equity investment generally increases in value) so does provide capital growth opportunity as well as potential income through dividends paid out by companies or funds. These investments are best when you have a longer-term horizon so you can ride out the bumps.

How this investment growth is treated from a tax perspective

Income earned and capital gains that are realised (when you sell something for more than you paid) have different tax consequences:

Taxes on interest earned:

South Africans under 65 years of age can earn R23,800 of interest every year without paying tax on interest earned (you need to have around R500,000 invested in a money market fund to earn this much).

Taxes on dividends:

If you own shares in local companies that pay dividends you will be automatically taxed 20% on these dividends. This will be taken off before you receive the dividends and paid to SARS on your behalf.

Taxes on capital gains:

South Africans under 65 are also exempt from any taxes on capital gains for the first R40,000 gain made every year. After that you will start owing the taxman at a rate of 40% of your marginal rate. ie if your marginal rate is 26%, you will have to pay 10.2% (40% x 26%) of your annual gain over R40,000 in tax. This is only triggered once you actually sell the investment.