Investing is basically putting your savings to work and can have a huge impact on your life. Good investments make money while you sleep, meaning you get more money for less work. The sooner you start the better because compound growth takes time to work its magic.

The sad reality is that many people think that unless they've got lots of spare money lying around, the best place to put their precious savings is in a bank account or even under the mattress. But the fact is that even if you only have a small amount of money you can start investing today.

In this blog, you'll learn about three simple steps that can get on the path toward long-term financial security and build up a nest egg that you'll be able to tap whenever you need it.

Here are our three simple steps for how you can start investing:

1. Invest first

You may have heard the expression pay yourself first. This means that you should put money aside at the start of every month instead of saving what is left at the end of the month.

It’s dangerous to leave investing to last because, in reality, most people will spend money if they have it (despite their best intentions), so chances are there’s nothing left to invest at the end of the month.

The smart way to invest first is by creating a simple budget that captures your typical monthly income and expenses. This will help you understand how much you can safely invest.

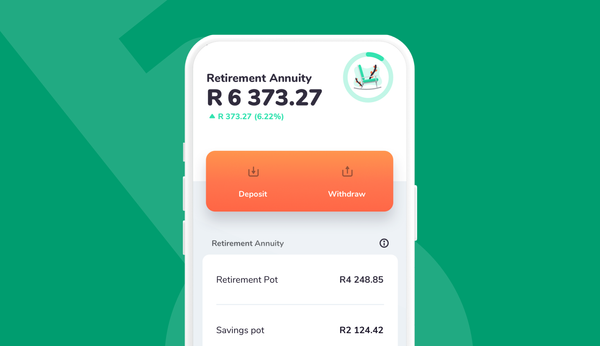

The next and most critical step is making sure you invest first. The best way to do this is to set up a monthly payment into your investment account on the 1st of every month. This way you can be sure that you won’t accidentally spend your monthly investment contributions.

2. Start an emergency fund

Most people associate investing with buying property, unit trusts or shares in a company. After all, we’ve all heard stories about people getting rich through these investment strategies.

These are indeed good places to invest. But if you’re new to investing, the first step is to create an emergency fund.

It is important to have a large margin of safety so you can deal with any financial shocks that may come your way – a medical emergency, unexpected car repairs, or even losing a job.

As a rule of thumb, your margin of safety should be three to six months' worth of living expenses. This will help you avoid going into debt or tapping into your long-term investments if you have a financial emergency.

It’s important to create your emergency fund that is easy to access and with returns that beat inflation (you can read more about why beating inflation is important here).

One of the best places to keep your emergency stash is in a money market fund. This way you can ensure that you can get access to your money whenever you need it without penalties and earn a risk free investment return that beats inflation.

3. Invest towards long term goals

Once you have financial emergencies covered, you're in a much better position to start investing towards long term goals. When you start thinking long term the three critical questions you must consider are investment returns, risks and costs.

Robo-advisors like Franc are a great way to learn about your financial needs so you can come up with an appropriate investing strategy without paying high fees to a financial advisor. Fee are deducted from investments and reduce returns – the lowest-cost investments typically offer the best returns.

A robo-advice platform uses information like age, income, expenses, investment experience and dependents to determine an investor profile tailored to your needs.

Most investments with significant returns come with investment risk. The best way of reducing investment risk is through diversification. We’re told as children don’t put your eggs into one basket – well, the same is true for investing.

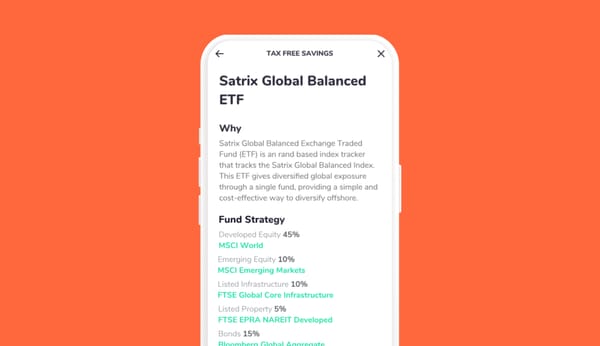

Index-tracking exchange traded funds (ETF) are a great way to invest in equities for those big long term goals, like your child’s education or a deposit on a house. These investment vehicles give you diversification by buying small amounts of many different shares even with a modest investment. And they are very low cost, which improves returns.

Don't wait!

As you can see, investing isn’t reserved for fancy people in suits with lots of money. In three simple steps you can start investing. So if you've been holding off investing, don't wait any longer. You'll be surprised what a difference it'll make in the long run.