Prices almost always go up. That’s inflation.

For example, if inflation is at 5%, a loaf of bread that costs R10 now is going to cost R10.50 this time next year. And although 50c doesn’t sound like much, in the long run the effects of inflation can be dramatic, particularly when you consider the impact on your investment returns.

At the end of five years your loaf of bread costs nearly R13. If your salary hasn't gone up you're almost 30% worse off because of inflation.

There are many misconceptions about inflation, like how it is calculated. Quite some effort goes into measuring inflation accurately.

The Government employs people who travel around the country and collect the prices of things most of us buy every month. The increase in the average of these prices is the inflation rate, also known as the consumer price index (CPI). Over the last five years CPI has ranged between 3.8% and 7% per annum in South Africa.

The process is fairly transparent and you can download the underlying data from the Stats SA website. If you like numbers, it makes for interesting reading.

Many people don’t believe the official inflation rate is accurate because it doesn’t represent the changes in their personal cost of living. I often hear people say, “I don’t know where they get that number — my expenses have gone up way more!” This may well be true. One reason for this is that price changes vary widely from one part of the country to another. Another reason — we don’t all buy the same stuff!

If you're interested, you can use the personal inflation rate calculator to work out your inflation rate compared to the national average.

So, how does inflation impact investing?

Whether the official inflation rate is accurate for you and your lifestyle or not, we can all agree that prices, on average, tend to go up over time. The cumulative effect of these little year-on-year price increases is significant.

What does this mean when it comes to saving and investing? You may have heard the expression savings are eroded by inflation. To put it differently, if you don’t invest your savings your money loses value over time.

Let’s say you distrust your bank so much that you decide to save by putting R500 a month under your mattress. You work out that in 5 years you will have R30,000. But in five years’ time — assuming inflation of 5% per year — that R30,000 is only going to have the buying power of R23,000 today. So you've effectively lost R7,000!

To preserve the buying power of your savings you have to earn a rate of return that equals or exceeds the rate of inflation. At 5% inflation something that costs R30,000 now will cost about R38,000 in 5 years’ time, which means that, following a monthly savings plan, you'll need to get a return of at least 9% to achieve your goal.

In a conventional savings account earning interest of 5% per year, saving R500 a month will result in about R34,000 in 5 years time, which means that you won't have enough money to buy the thing you had your eye on.

What does “Real Rate of Return” mean?

So now that we understand inflation, we should ask the question, what does that return mean for our investment, in inflation-adjusted terms? In other words, what is the "real" rate of return on our investment?

In simple terms, this is the rate of return on your investment less the inflation rate. If you invest in a money market fund paying interest of 8% per year and inflation stays at 5%, then your real rate of return is 3% per annum. In contrast, a savings account with an interest rate of 3.5% has a real rate of return -1.5%, which means your money will actually lose spending value over time.

This is why knowing the real rates of return lets you evaluate investment prospects in terms of today’s money.

That's why investing for growth is so important

When you consider the way that inflation eats away your savings, it’s easier to understand why some investors are prepared to take on some risk to get better rates of return.

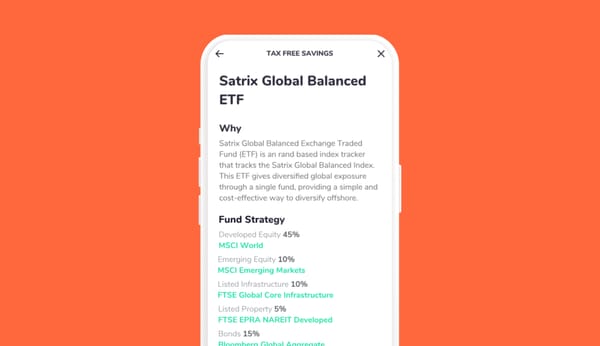

For example, over ten years to March 2019 the Satrix Top40 ETF (the equity fund available to Franc members) gave investors an annual rate of return of 19.25%. That’s a “real” rate of return of about 14% per year!

To put this in perspective, if you were to invest R10,000 today at a real rate of 14% per annum, your balance in ten years’ time would have the purchasing power of R24,000 in today’s terms. Now, that’s an investment that starts to make more sense.