The idea of drinking one less cappuccino every day and investing the money is not new.

If you don’t drink coffee, pick an indulgence — chocolate, wine, cigarettes, massages, fast food — we all spoil ourselves.

Lockdown means that most of us have been forced to spoil ourselves less. I've saved a small fortune in the (involuntary) suspension of my cappuccino habit. And I ran out of beer halfway through level 5. I adjusted – it wasn't as hard as I expected.

Most of us have learned two things from the lockdown:

- We need less coffee, wine and other indulgences than we've gotten used to;

- The cost of indulgences is more than we thought.

Lockdown is frustrating, but it's also an opportunity to take advantage of new habits. Instead of going back to your favourite indulgences as soon as lockdown permits, why not limit those luxuries a teeny bit and invest your savings?

Over 15 years, R500 a month invested in an equity fund could turn into R300,000 or more.

Humans are primed for immediate gratification and denying oneself often feels like a very old-fashioned idea. Enjoying a coffee now feels good, whereas getting a bit of extra money at some indeterminate future time is… well, meh.

But lockdown has taught us that we can do with less of our indulgences. If you limit your indulgences and invest the savings you might be surprised at the results.

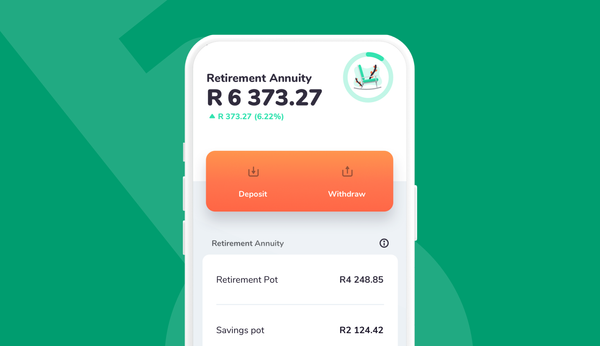

Turning coffee into an asset

At R25 a cup, skipping one takeout coffee every working day works out to around R500 a month.

If you’d invested R500 a month for the last 5 years in a money market fund you’d have R36,500 today. That’s right, 5 years of coffee takeouts have cost you R36,500!

In fact, it might have cost you more.

Over the 20 year period to the end of December last year, the JSE All Share Index returned an average of 13.7% a year.

If you'd invested R500 a month in an equity fund and enjoyed a return of 13.7%, your account would have been worth R43,200 at the end of 5 years.

Over a 1o year period at the same rate of return, R500 a month turns into R128,000. Over 15 years? Almost R300,000.

Risk and Return

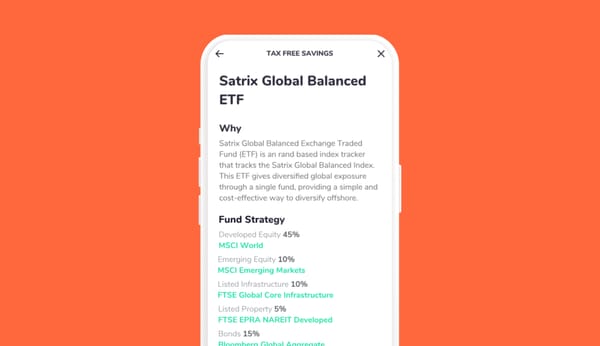

Why does money grow so much more in an equity fund?

The reason is that shares are more volatile than interest-earning investments, and the uncertainty of the outcome in the share market means that shareholders are rewarded with higher returns for taking on some risk.

Money market funds – which are much like savings accounts that gives you access to institutional interest rates – can never go down in value. The rate of interest might drop, as it has recently, but these funds continue to earn interest.

These are safe investments – there is no risk of losing money.

In the share market, on the other hand, prices can plummet – as they did between mid-February and mid-March this year – and rocket – as they've done since then.

Equity funds are risky because if you have to take out money for some reason when the market is down, you can end up with less than you invested. But this problem largely goes away if you can invest for five years or more and can avoid selling in a major market dip.

A fund like the Satrix 40 ETF tracks the prices of the largest companies listed on the stock exchange and shares in the huge profits those companies make. In the long term, those profits usually give better returns than interest – but you have to be willing to stick with the market through its ups and downs.

This is why at Franc we recommend a money market fund for shorter-term goals and an equity fund for long-term goals.

We can’t promise that future returns will match those shown above. But based on past experience, there’s a good chance that investing a coffee a day (or R500 per month) for the next 10 years could result in a windfall of somewhere between R75,000 and R130,000.

Isn't that a good reason to drink a few less cappuccinos?

Challenge yourself – see where you've saved money during the lockdown and put that money to work.